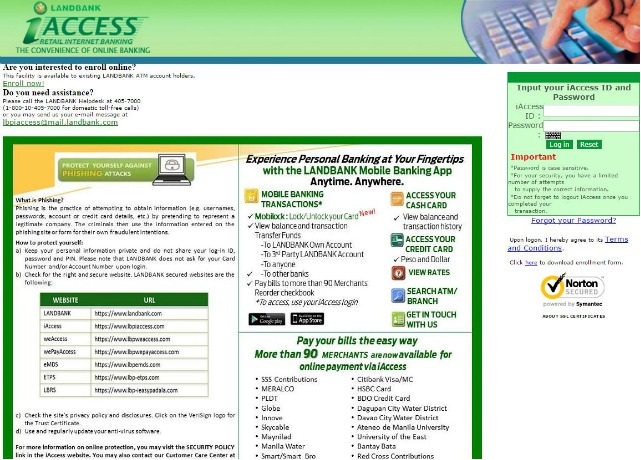

How do you withdraw money from PayPal to your Philippine bank account. If you’re in the Philippines and wish to withdraw your money from PayPal funds, you can do so by following this process in transferring funds.

Filipinos in the Philippines are making money online and they are getting paid via PayPal. Now, some newbie Filipino virtual assistant in the Philippines might wonder how to encash their ecurrency (the funds in their PayPal account).

Step 1: Add Philippine Bank Account or Credit/Debit Card to Paypal Account

The first thing to do is to add a bank account in your PayPal account. Just write your bank account details. Make sure you filled up the required information correctly. Your complete name as written in your bank account and in you PayPal account should match.

Also, write your bank account number correctly.

- Account Settings > Profile > Add/Edit Bank Account; or

- Banks and cards > Add a bank account or card

You must input the correct bank code. I have a BDO account. Write the complete name of the bank. Say for example, Bank of the Philippine Islands, UnionBank of the Philippines, Metrobank, Banco de Oro, Security Bank, etc. and insert the correct bank code.

The bank codes in the Philippines can be available in the filling out process. It is important to write your bank account details correctly because there will be a corresponding return fee of 250 pesos when you request funds from PayPal account to the incorrect bank account details.

Top 5 Popular Philippine Bank Codes Used in Paypal

| Bank Name | Bank Code | |

|---|---|---|

| 1 | BANCO DE ORO (BDO) | 010530667 |

| 2 | BANK OF THE PHILIPPINE ISLANDS (BPI) | 010040018 |

| 3 | METROPOLITAN BANK & TRUST CO. (METROBANK) | 010269996 |

| 4 | SECURITY BANK | 010140015 |

| 5 | UNION BANK OF THE PHILIPPINES (UBP) | 010419995 |

Step 2: Request to Withdraw Paypal funds

To request a withdraw in your PayPal account, just go to the My Account > Withdraw section and choose your withdrawal option.

If you wish to transfer funds to your Philippine bank account, click the Withdraw funds to your bank account link.

Step 3: Input withdrawal Amount and Choose Bank Account

Just enter the amount of money you wish to withdraw.

Be sure you also choose the bank account where you want the PayPal funds to be transferred. Once you are done, click Continue.

Step 4: Review before you confirm

Have time to review the details of your withdrawals request. You can cancel or edit the details, anyway. Be reminded that PayPal charge withdrawal fees and return fees if you used incorrect details of your bank account.

Step 5: Submit Your Request

Check your requested withdrawal in the Transaction History. Pending request are not completed, they’re in a review. While “completed” are those successful transaction processed.

There will be 2 to 4 days of processing period if you will withdraw PayPal funds to Philippine bank accounts. If you have any question, just leave a comment below.

Can i use the bank code for bpi that you posted?