The Federal Open Market Committee (FOMC) holds a paramount position in the global financial landscape, wielding significant influence over monetary policy decisions in the United States. Comprising key officials from the Federal Reserve, including the Board of Governors and regional Federal Reserve Bank presidents, the FOMC convenes regularly to assess economic conditions, set interest rates, and formulate monetary policy strategies aimed at fostering economic stability and growth.

FOMC Meetings and Their Impact

FOMC meetings are closely monitored by investors, traders, and policymakers worldwide, as they provide crucial insights into the Federal Reserve’s outlook on the economy and its stance on monetary policy. The decisions and statements emanating from FOMC meetings can have far-reaching implications for various asset classes, including stocks, bonds, currencies, commodities, and cryptocurrencies. Understanding the dynamics of FOMC meetings and their impact on financial markets is essential for traders and investors seeking to navigate market volatility and capitalize on trading opportunities.

Trading During FOMC Meetings

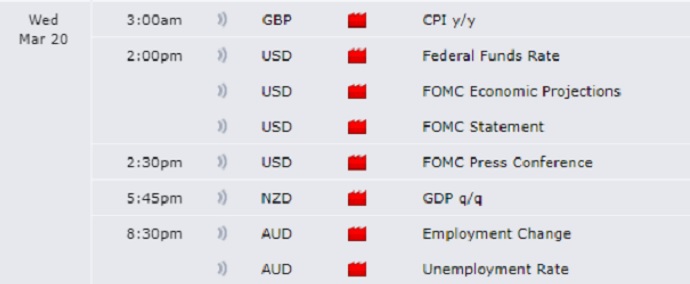

Trading during FOMC meetings presents both challenges and opportunities for market participants. The release of FOMC statements, interest rate decisions, economic projections, and press conferences by the Federal Reserve Chair can trigger sharp fluctuations in asset prices, leading to heightened volatility and trading activity. Traders must exercise caution and employ risk management strategies to mitigate potential losses during periods of market turbulence.

Insights for FOMC Day Trading

Day traders often seek to capitalize on short-term price movements generated by FOMC announcements and market reactions. By analyzing market sentiment, technical indicators, and historical price patterns, day traders can identify potential entry and exit points for their trades. It is essential to remain disciplined, patient, and adaptable in response to evolving market conditions during FOMC meetings.

Understanding FOMC in Different Markets

FOMC decisions and announcements impact various financial markets, including forex, stocks, bonds, commodities, and cryptocurrencies. Let’s explore how FOMC affects different asset classes and the key considerations for traders in each market segment:

FOMC in Forex Trading

In forex trading, FOMC announcements can lead to significant volatility in currency pairs, particularly those involving the US dollar (USD). Traders closely monitor interest rate decisions, forward guidance, and economic projections issued by the Federal Reserve to gauge the USD’s strength or weakness relative to other currencies. Changes in interest rates and monetary policy outlooks can influence forex trading strategies, such as carry trades, trend following, and range trading.

FOMC on Gold

Gold prices often react sharply to FOMC announcements and monetary policy decisions. Traditionally viewed as a safe-haven asset, gold tends to appreciate in value when investors perceive heightened uncertainty or inflationary pressures. FOMC statements signaling dovish or accommodative monetary policies may lead to a depreciation of the USD and a rally in gold prices. Conversely, hawkish or tightening measures by the Federal Reserve could exert downward pressure on gold prices.

FOMC Impact on Stock Market

The stock market is sensitive to changes in interest rates, inflation expectations, and economic growth prospects communicated by the FOMC. Equity investors analyze FOMC statements and economic data releases to assess corporate earnings potential, industry trends, and overall market sentiment. Bullish or dovish signals from the Federal Reserve may fuel stock market rallies, while bearish or hawkish signals could trigger sell-offs or corrections.

FOMC and Cryptocurrencies

Cryptocurrency markets are relatively nascent and highly speculative, making them susceptible to volatility during FOMC meetings. While cryptocurrencies like Bitcoin and Ethereum are not directly influenced by traditional monetary policy tools, they can still experience price fluctuations in response to changes in investor risk appetite, macroeconomic trends, and regulatory developments. Traders in the crypto space closely monitor FOMC news and market sentiment to capitalize on short-term trading opportunities.

Strategies for Trading FOMC Minutes

Trading FOMC minutes requires a strategic approach and a thorough understanding of market dynamics. Here are some strategies and tips for trading FOMC minutes effectively:

Preparing in Advance

Ahead of FOMC meetings, traders should conduct comprehensive research, analyze economic data, and formulate trading plans based on various scenarios and outcomes. Anticipating market reactions and identifying key support and resistance levels can help traders make informed decisions during fast-moving market conditions.

Monitoring News Feeds

During FOMC meetings, traders should stay abreast of live news feeds, official statements, and press releases from central banks and financial institutions. Rapid dissemination of information is essential for interpreting market sentiment and adjusting trading strategies accordingly.

Using Technical Analysis

Technical analysis tools such as candlestick patterns, trend lines, and support/resistance levels can provide valuable insights into market trends and price movements during FOMC minutes trading. Traders may also employ momentum indicators, oscillators, and volume analysis to confirm trade signals and identify entry/exit points.

Managing Risk

Risk management is paramount when trading FOMC minutes, given the heightened volatility and uncertainty surrounding market reactions. Traders should define risk tolerance levels, set stop-loss orders, and allocate capital prudently to avoid excessive losses. Diversifying trading positions across multiple asset classes and adopting hedging strategies can help mitigate downside risks.

Final Thoughts

FOMC meetings play a pivotal role in shaping monetary policy, influencing financial markets, and driving investor sentiment. By understanding the intricacies of FOMC announcements, traders can navigate market volatility, capitalize on trading opportunities, and manage risk effectively. Whether trading forex, stocks, commodities, or cryptocurrencies, staying informed, disciplined, and adaptable is essential for success in FOMC minutes trading. With careful planning, diligent analysis, and disciplined execution, traders can harness the potential of FOMC meetings to achieve their financial goals and navigate the ever-changing landscape of global markets.

Share your thoughts, strategies, successes, and challenges in trading FOMC. How do you prepare for FOMC meetings? What trading strategies do you employ during FOMC minutes? Have you experienced significant market moves or unexpected outcomes during FOMC events?

Leave a comment below and join the conversation! Happy trading! 🚀📊

DISCLAIMER: The information provided on InvestmentTotal.com is for general informational purposes only. The content on this website is not intended to be, and should not be construed as, professional financial advice.