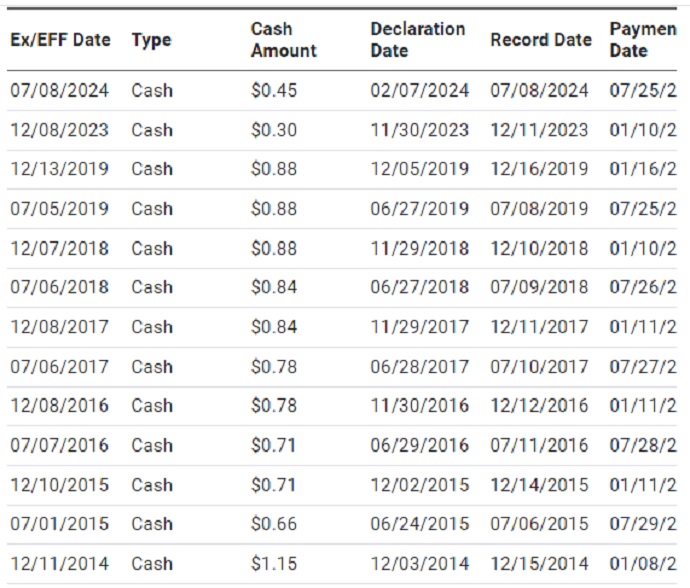

DIS Dividend history and yield! The dividend history of The Walt Disney Company indicates a current yield of 0.33%, reflecting its commitment to returning value to shareholders. While this yield may be relatively modest compared to other investment opportunities, Disney’s consistent dividend payments can still contribute to a diversified income-generating portfolio.

The Walt Disney Company (DIS) is a global entertainment powerhouse that has captured the imaginations of audiences for nearly a century. Founded by Walt Disney and his brother Roy O. Disney in 1923, the company has grown from a small animation studio into one of the most influential and diversified entertainment conglomerates in the world.

One aspect of investing in companies like Disney is the allure of dividends. Dividends are payments made by a corporation to its shareholders, typically as a distribution of profits. For many investors, dividends are a key component of their investment strategy, providing a steady stream of income in addition to the potential for capital appreciation.

Disney has a long history of paying dividends to its shareholders, making it an attractive investment for income-oriented investors. The company’s dividend payments reflect its commitment to returning value to shareholders and its confidence in its ability to generate consistent cash flows over the long term.

It’s important to note that dividends are not guaranteed and can fluctuate based on various factors, including the company’s financial performance, strategic priorities, and economic conditions. In times of economic uncertainty or when companies prioritize reinvesting profits into growth initiatives, dividend payments may be reduced or suspended altogether.

Investors considering Disney for its dividend potential should conduct thorough research into the company’s financial health, growth prospects, and dividend history. While dividends can be an appealing feature of investing in established companies like Disney, they should be viewed as just one aspect of a comprehensive investment strategy.

DIS Dividend History – Yielding 0.33%

A 0.33% dividend yield might be considered relatively low compared to other investment opportunities or historical averages. Many investors seek higher dividend yields, especially those focusing on income-generating investments.

For comparison, some sectors or stocks may offer higher dividend yields, such as utilities, real estate investment trusts (REITs), or certain dividend-paying stocks in mature industries.

It’s essential to consider the broader picture. For instance, if an investor is interested in a company like a technology or growth stock, a lower dividend yield might be acceptable or even expected, as these companies typically prioritize reinvesting profits into growth initiatives rather than paying out dividends.

DISCLAIMER: The information provided on InvestmentTotal.com is for general informational purposes only. The content on this website is not intended to be, and should not be construed as, professional financial advice.