Roth IRA is a retirement savings account that allows individuals to contribute after-tax income, and in return, enjoy tax-free growth and withdrawals during retirement. Unlike Traditional IRAs where contributions are tax-deductible but withdrawals are taxed, Roth IRAs offer tax-free withdrawals, making them an attractive option for individuals seeking tax diversification in retirement. One of the key advantages of Roth IRAs is the flexibility they offer in terms of contributions and withdrawals. Unlike Traditional IRAs, Roth IRAs do not have required minimum distributions (RMDs) during the account owner’s lifetime, allowing for greater control over retirement income planning. Additionally, Roth IRAs allow for penalty-free withdrawals of contributions (not earnings) at any time, providing a valuable source of emergency funds or flexibility in financial planning.

Roth IRAs are available to individuals who meet certain income requirements set by the IRS. For the tax year 2024, single filers with modified adjusted gross incomes (MAGIs) below $144,000 and married couples filing jointly with MAGIs below $214,000 are eligible to make the maximum contributions to Roth IRAs. Contributions to Roth IRAs are subject to annual limits set by the IRS. For 2024, the contribution limit is $6,000 for individuals under 50 years of age and $7,000 for those aged 50 and older, including catch-up contributions. It’s important to note that contributions to Roth IRAs must be made with earned income, such as wages, salaries, or self-employment income, and cannot exceed the individual’s total annual compensation for the year. Understanding the eligibility criteria and contribution limits is essential when considering opening a Roth IRA account with Fidelity Investments.

Why Choose Fidelity Investments for Your Roth IRA?

Fidelity Investments stands out as a premier choice for Roth IRA investors due to its long-standing reputation, comprehensive range of investment options, and user-friendly platform. With over seven decades of experience in the financial industry, Fidelity has earned the trust of millions of investors worldwide. The company’s commitment to financial strength and stability provides investors with confidence in their retirement savings journey. Fidelity has consistently received industry recognition and awards for its innovative products, investment management, and customer service, further solidifying its position as a top choice for Roth IRA investors.

One of the key benefits of choosing Fidelity Investments for your Roth IRA is the diverse range of investment options available. Fidelity offers access to a wide array of investment vehicles, including mutual funds, exchange-traded funds (ETFs), individual stocks and bonds, target date funds, and more. This extensive selection allows investors to build a diversified portfolio tailored to their individual risk tolerance, investment goals, and time horizon. Additionally, Fidelity’s low fees and expenses make it an attractive option for cost-conscious investors seeking to maximize their investment returns. With competitive expense ratios and no account maintenance fees for Roth IRA accounts, Fidelity ensures that investors can keep more of their hard-earned money working for them over the long term.

Getting Started with Fidelity Investments Roth IRA

Opening a Roth IRA with Fidelity Investments is a straightforward process that can be completed entirely online. Prospective investors can visit Fidelity’s website and navigate to the Roth IRA section to begin the application process. The online application typically requires basic personal information, including name, address, Social Security number, and employment details. Additionally, applicants may need to provide documentation to verify their identity and eligibility, such as a government-issued ID and proof of income. Once the application is submitted, Fidelity’s account opening team will review the information provided and notify the applicant once the account has been approved and funded.

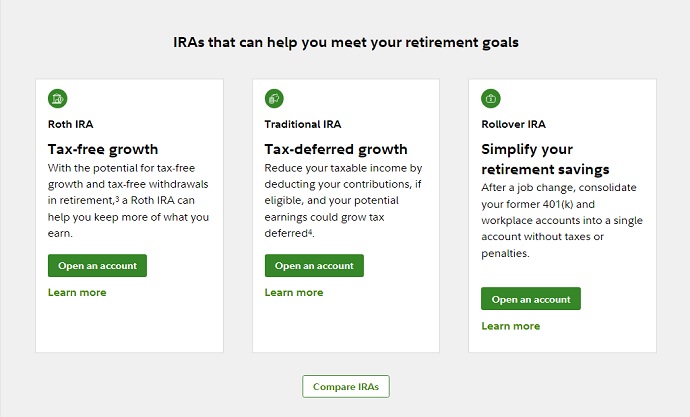

Funding your Roth IRA with Fidelity Investments is easy and convenient, with multiple options available to suit individual preferences. Investors can choose to make contributions through electronic funds transfer (EFT) from their bank account, payroll deductions, or by mailing a check to Fidelity. It’s important to be aware of the contribution limits and deadlines set by the IRS, as exceeding these limits or missing deadlines can result in penalties and tax implications. Fidelity also offers the flexibility to transfer or rollover funds from an existing retirement account, such as a Traditional IRA or employer-sponsored 401(k), into a Roth IRA. This allows investors to consolidate their retirement savings and take advantage of the tax benefits offered by Roth IRAs.

Investment Options and Strategies

Fidelity Investments offers a wide range of investment options to suit investors of all risk tolerances and investment objectives. One popular option for Roth IRA investors is Fidelity’s selection of mutual funds, which cover various asset classes, including stocks, bonds, and alternative investments. Investors can choose from actively managed funds, passively managed index funds, and target date funds, depending on their preferences and investment strategy. Additionally, Fidelity offers a diverse lineup of exchange-traded funds (ETFs), providing investors with access to specific sectors, industries, or geographic regions at a lower cost compared to traditional mutual funds.

Individual stocks and bonds are another option available to Roth IRA investors through Fidelity Investments. Investing in individual securities allows investors to build a customized portfolio tailored to their unique preferences and investment goals. Fidelity offers research tools and educational resources to help investors make informed decisions when selecting individual stocks and bonds. It’s important for investors to diversify their portfolios across different asset classes and sectors to mitigate risk and maximize potential returns over the long term. Target date funds are a convenient option for investors seeking a hands-off approach to retirement investing. These funds automatically adjust the asset allocation over time based on the investor’s target retirement date, gradually shifting towards a more conservative investment mix as the retirement date approaches. Fidelity offers a range of target date funds with varying risk profiles to suit investors at different stages of their retirement journey.

Managing Your Roth IRA Portfolio

Managing your Roth IRA portfolio with Fidelity Investments involves regular monitoring and periodic adjustments to ensure that your investments align with your financial goals and risk tolerance. One essential aspect of portfolio management is rebalancing, which involves realigning the asset allocation of your portfolio back to its target weights. Fidelity offers tools and resources to help investors automate the rebalancing process and maintain a disciplined investment approach. By rebalancing regularly, investors can control risk and potentially enhance returns over time.

Monitoring the performance of your Roth IRA investments is crucial for making informed decisions and identifying opportunities for optimization. Fidelity provides access to comprehensive performance tracking tools, allowing investors to monitor the performance of their portfolio, analyze investment returns, and evaluate the impact of market fluctuations. By staying informed about market trends and economic developments, investors can adjust their investment strategy accordingly and take advantage of potential opportunities to enhance portfolio performance.

Tax considerations are also an important aspect of managing your Roth IRA portfolio with Fidelity Investments. Roth IRAs offer tax-free growth and withdrawals, making them an attractive vehicle for retirement savings. However, it’s essential to be mindful of potential tax implications when making investment decisions within your Roth IRA. Fidelity offers tax-efficient investing strategies to help investors minimize their tax liability and maximize after-tax returns. By strategically managing the tax implications of their investments, investors can optimize their overall investment returns and achieve their long-term financial goals.

Planning for Retirement

Planning for retirement involves careful consideration of various factors, including estimating retirement expenses, creating a withdrawal strategy, and optimizing tax efficiency. Fidelity Investments offers comprehensive retirement planning tools and resources to help investors navigate the complexities of retirement planning and achieve their financial objectives. One essential aspect of retirement planning is estimating retirement expenses, including healthcare costs, housing expenses, and discretionary spending. Fidelity’s retirement expense estimator helps investors calculate their expected retirement expenses and develop a realistic budget for retirement.

Creating a withdrawal strategy is another critical component of retirement planning. Fidelity offers retirement income planning tools to help investors determine the most tax-efficient way to withdraw funds from their Roth IRA and other retirement accounts during retirement. By strategically timing withdrawals and managing the tax implications of distributions, investors can maximize their retirement income and minimize their tax liability. Fidelity’s retirement income planning tools allow investors to explore different withdrawal strategies and compare the potential outcomes to make informed decisions about their retirement finances.

Roth IRA conversion strategies can also play a significant role in retirement planning. Converting a Traditional IRA to a Roth IRA can provide tax diversification and flexibility in retirement. Fidelity offers resources and guidance to help investors navigate the Roth IRA conversion process and evaluate the potential tax implications. By strategically timing Roth IRA conversions and managing the tax consequences, investors can optimize their retirement savings and achieve their long-term financial goals. Fidelity’s retirement planning tools and resources empower investors to take control of their retirement finances and make informed decisions about their financial future.

Advanced Strategies and Tips

For investors seeking to maximize their retirement savings, Fidelity Investments offers advanced strategies and tips to optimize their Roth IRA accounts. One such strategy is the backdoor Roth IRA contribution method, which allows high-income earners to circumvent the income limits for direct Roth IRA contributions. Fidelity provides guidance and support for investors interested in utilizing this strategy, ensuring compliance with IRS regulations and maximizing tax benefits. By leveraging the backdoor Roth IRA contribution method, investors can take advantage of the tax-free growth and withdrawals offered by Roth IRAs, regardless of their income level.

Another advanced strategy available to Roth IRA investors is the mega backdoor Roth IRA, which involves utilizing employer-sponsored retirement plans, such as 401(k) and 403(b) plans, to make additional after-tax contributions that can be converted into a Roth IRA. Fidelity offers resources and educational materials to help investors navigate the complexities of the mega backdoor Roth IRA strategy and maximize their retirement savings potential. By strategically leveraging employer-sponsored retirement plans and utilizing the mega backdoor Roth IRA strategy, investors can significantly increase their tax-advantaged retirement savings and achieve their long-term financial goals.

Additionally, Roth IRAs can serve as a valuable tool for education savings, providing flexibility and tax benefits for funding higher education expenses. Fidelity offers guidance and support for investors interested in using their Roth IRA accounts to save for college tuition, room and board, and other qualified education expenses. By strategically allocating contributions to their Roth IRA accounts and utilizing tax-free withdrawals for education expenses, investors can optimize their education savings and minimize their tax liability. Fidelity’s education savings tools and resources empower investors to achieve their education funding goals while maximizing the tax benefits of their Roth IRA accounts.

Frequently Asked Questions (FAQs)

As investors consider opening a Roth IRA with Fidelity Investments, they may have questions about eligibility, contributions, withdrawals, and other aspects of retirement planning. In this chapter, we address some of the most frequently asked questions to provide clarity and guidance for prospective investors.

Can I have multiple Roth IRAs with Fidelity?

Yes, investors can have multiple Roth IRA accounts with Fidelity Investments. However, the total contributions to all Roth IRAs in a given tax year must not exceed the annual contribution limits set by the IRS.

What are the penalties for early withdrawal from a Roth IRA?

While Roth IRAs offer flexibility in terms of withdrawals, early withdrawals of earnings (not contributions) before age 59½ may be subject to taxes and penalties, unless an exception applies.

Can I contribute to a Roth IRA if I have a 401(k) plan?

Yes, individuals can contribute to both a Roth IRA and a 401(k) plan simultaneously, as long as they meet the eligibility criteria for each account and adhere to the contribution limits set by the IRS.

How do I convert a Traditional IRA to a Roth IRA with Fidelity?

Fidelity offers a straightforward process for converting a Traditional IRA to a Roth IRA. Investors can initiate the conversion online or contact Fidelity’s customer service for assistance with the conversion process.

What happens to my Roth IRA if I change jobs?

If you change jobs, your Roth IRA remains intact and can continue to grow tax-free. You may choose to leave your Roth IRA with Fidelity Investments or transfer it to another financial institution, depending on your preferences and investment objectives.

Final Thoughts

Investing in a Roth IRA with Fidelity Investments offers investors a powerful opportunity to build wealth and secure their financial future. By understanding the fundamentals of Roth IRAs, leveraging Fidelity’s comprehensive range of investment options and advanced strategies, and implementing sound retirement planning techniques, investors can embark on a path towards a comfortable and fulfilling retirement. Fidelity’s commitment to financial strength, stability, and exceptional customer service makes it a trusted partner for investors seeking to achieve their long-term financial goals. Start your Roth IRA journey with Fidelity Investments today and take control of your retirement future.

Website: https://www.fidelity.com/retirement-ira/overview

DISCLAIMER: The information provided on InvestmentTotal.com is for general informational purposes only. The content on this website is not intended to be, and should not be construed as, professional financial advice.