The best dividend stocks to buy and hold are those companies that pay stock holders a regular earnings. Shareholders can get their dividend earnings on monthly, quarterly, or on a yearly basis. Watch out for the best dividend stocks regularly by searching the companies dividend yield, it is the basis for dividend stocks calculated by dividing the yearly dividend amount by the company’s stock price. Of course dividend yield are not steady, it can fluctuates as the company stock price are fluctuating, too. Many savvy and sophisticated investors are considering the dividend yield when picking which stocks to invest in.

Best Dividend Stocks to Buy and Hold

Investing in the best dividend stocks to buy and hold is a tried-and-true strategy for building long-term wealth and financial stability. Investing in dividend stocks is also one good way to avoid losing money in stocks.

These stocks represent companies with a history of consistent dividend payments and strong fundamentals. By selecting such stocks, investors can enjoy not only a regular stream of income in the form of dividends but also the potential for capital appreciation over time. The key to success in this strategy lies in selecting companies with a track record of stability, a competitive advantage in their industry, and the ability to generate sustainable cash flows.

By patiently holding onto these dividend-paying stocks, investors can harness the power of compounding, allowing their investments to grow steadily and provide financial security for the future. The best dividend stocks to buy and hold are the cornerstone of a sound, long-term investment portfolio.

Should You Buy and Hold Dividend Stocks Because it Offers Passive Income

Yes, buying and holding dividend stocks can be a prudent strategy for those seeking passive income. Dividend stocks provide a consistent stream of income without the need for active trading or constant attention to the stock market. By selecting companies with a history of stable dividend payments and strong financials, investors can create a reliable source of passive income.

This income can be especially valuable for retirees or anyone looking to supplement their earnings without the daily involvement of active trading. It’s essential to conduct thorough research and choose dividend stocks wisely to ensure the sustainability of the income stream. Consider your long-term financial goals and risk tolerance when deciding whether to buy and hold dividend stocks as part of your investment strategy.

How Do I make $500 a Month in Dividends?

To make $500 a month in dividend stocks, you only have to calculate some things;

- $500 X 12 months = $6,000

- $6,000 divide by dividend yield = the amount required to invest in dividend stocks

In this example, if John Doe invest in dividend stocks worth $150,000 that pays 4% per year. John Doe will receive $6,000 per year or $500 per month.

Is It Good to Have Dividend Stocks?

Definitely, yes! It is because dividend stocks will give you passive income. Instead of investing in stocks, and buy and hold strategy, you can earn passive income. In this way, you can multiply your holdings or number of shares in long term because you can receive cash or stocks.

The compounding effects in investing is amazing. Take advantage of the best dividend stocks that will give you some cash to buy more company shares. Read the Snow Ball Effect popularized by Warren Buffett to learn about this.

Ways to Find the Best Dividend Stocks to Buy and Hold

Finding the best dividend stocks requires diligent research and a well-thought-out strategy. Here are some places and methods to help you identify potential dividend stocks:

Online Stock Screeners

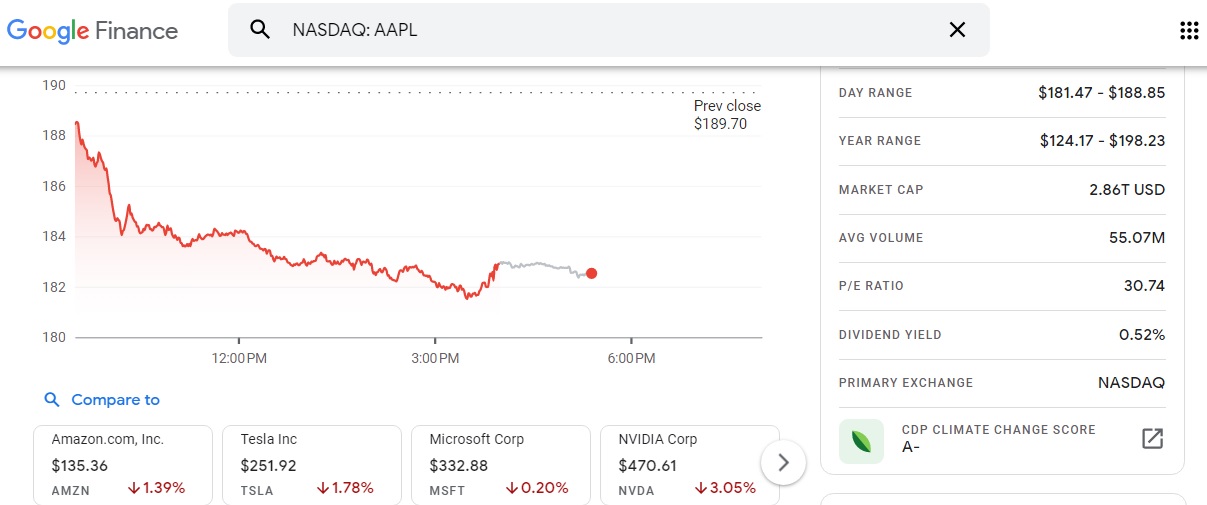

Utilize stock screeners available on financial websites like Yahoo Finance, Google Finance, and Stock Screener on MarketWatch. These tools allow you to filter stocks based on criteria like dividend yield, dividend history, and other financial metrics.

Dividend-Focused Websites

Websites such as Seeking Alpha, Dividend.com, and Dividend Growth Investor provide curated lists of dividend-paying stocks, along with analysis and insights from experts in the field.

Herein Investing Daily, we would like to publish also the best dividend stocks on a monthly basis. So stay tuned to our Investing Topics and Discussions here.

Dividend Aristocrats

Look for stocks that are part of the S&P 500 Dividend Aristocrats index. These are companies that have a history of consistently increasing their dividends for at least 25 consecutive years, making them a reliable source of income.

Financial News and Magazines

Keep an eye on financial news outlets like CNBC, Bloomberg, and Forbes. They often feature articles and lists of recommended dividend stocks.

ETFs and Mutual Funds

Consider investing in dividend-focused exchange-traded funds (ETFs) or mutual funds. These funds hold a diversified portfolio of dividend-paying stocks, reducing individual stock risk.

Dividend Growth Stocks Lists

There are various lists and publications that highlight dividend growth stocks. The book “The Dividend Aristocrats” by David Dierking is an example of a resource that can guide you to reliable dividend stocks.

Brokerage Research

Many brokerage platforms provide research and tools to help you identify dividend stocks. Some even offer their own lists of recommended stocks.

Dividend Stock Forums

Engage with online investment communities and forums like the Seeking Alpha community or Reddit’s r/dividends. You can get insights, opinions, and recommendations from other investors.

Company Investor Relations

Visit the investor relations section of a company’s website. It often contains information about the company’s dividend history and financial health.

Professional Financial Advisors

Consult with a financial advisor or portfolio manager who specializes in income-focused investing. They can provide personalized guidance based on your financial goals and risk tolerance.

Remember that the best dividend stocks for you may depend on your specific financial situation, investment goals, and risk tolerance. Diversifying your dividend stock portfolio across various sectors and industries can also help mitigate risk and enhance your overall income strategy. Always conduct thorough research and due diligence before making any investment decisions.

If you’re an investor or have experience with dividend stocks, please feel free to share your insights, tips, or questions in the comments below. Your comments can provide valuable perspectives and contribute to the discussion on dividend investing.

DISCLAIMER: The information provided on InvestmentTotal.com is for general informational purposes only. The content on this website is not intended to be, and should not be construed as, professional financial advice.