Stocks trading seems very popular nowadays. Many people wants fast money. But the real money in stock market will come to those who can patiently wait and for those who know what they’re doing. According to Warren Buffet, “‘Only buy something that you’d be perfectly happy to hold if the market shut down for 10 years”. Noone can predict the stock market. Maybe trending today, and ranging tomorrow. Maybe the market is doing good this month and one words from President Joe Biden will crash the market. During the pandemic, there are worried investors who pull their money and opportunistic investors who made a lot of money.

Think about this, Warren Buffet became rich in stock market value investing. In the quoted words above, let me ask you, are you happy in the stocks you bought? Do you believe in the company management, products and services? Well, if you say YES, congrats.

I have a friend who asked me, is it profitable to hold the stocks or much better to just scalp the market or just day trade and make a decent living by buying and selling stocks? You will only become profitable when you know what you’re doing. This is not the best answer but I believe you must understand yourself first. Here are some simple rules when you want to become both day trader and a long term investor.

Investor’s Investing in the Stock Market Rules: Know what you’re doing. Have some sense in “value investing” and make use of dollar cost averaging. Simple rules, isn’t it?

Stocks Day Traders Rules:

- Know your trading style

- Have developed a trading system that you must RESPECT and STRICTLY FOLLOWED whatever the market is doing

- Have deep understanding about fundamentals and technical analysis

- Have a risk reward ratio trading system

- Money management is the queen

- Trading psychology is the king

- No stop loss will lead you to margin call

- Cut losses quick, let your winners run

Value Investing VS Stock Day Trader – Get Rich or Get Richer?

Maybe you will ask yourself now, what’s value investing and how it makes difference to day trading stocks?

Value Investing

The Scenario: Value investors buy “undervalued stocks” which they think and are happy holding that stocks for around few months, to few years and sometimes forever, because of not just the “stock price” is low or undervalued but for the products and services provide by the company to its customers. While day traders buy stock today and sell the stock today to make profit for the day.

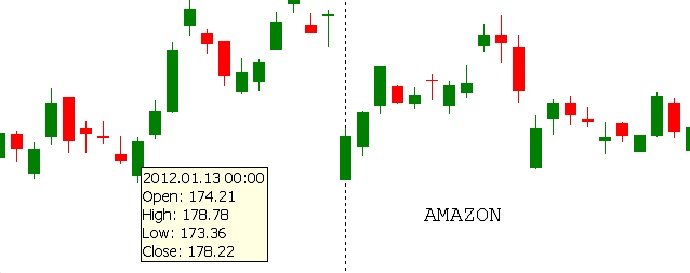

Example: See Chart

On January 13, 2012 AMAZON stock price can buy for only $174.21 , if you have $20,000 you can buy AMAZON stocks for 114 shares. Now the stock price of Amazon is 3,331.00 per share.

Your 20,000 US Dollars will turn int0 $379,734 as of this writing February 5, 2021. You only have to wait some years. If on 2012, you valued “AMAZON”, you must have this money now. Dividends and compounding wasn’t discussed here, you will become amaze to stock value investing if we do so.

Stock Day Trading with an Edge and RRR

The scenario of a stock day trader wants to make money daily. Here is what you want to also want to know. I usually buy stocks and hold it, sometimes due to curiosity, I day trade stocks. Often times I trade forex especially GBPUSD that currency pair is my favorite. When it comes to stocks, I will screen stocks in my chart and look for opportunity.

If you have developed a trading system, don’t change or replace that system. All you need to do is to insert some of this useful principle to make yourself a profitable trader. A profitable trader as an “EDGE” to the market. That edge will put many favors in your side.

Example edge: The probability market price system using exponential moving average, you heard the 50 EMA and 200 EMA many times. When crossed, it is a sign that trend will reverse.

Another edge, you know the trend is UP and analyze it carefully. You know the support and resistance, that’s an edge. You don’t know anything, that’s gambling!

Assuming you have a risk reward ratio of 1:3. For every risk $100, you will make $300. If you’re wrong, you lose $100, if you’re right your trade will give you $300

For 10 trades, because you are capable of being a day trader, you have 50/50 chances of win. Out of 10 trades you only win 5 trades.

RISK to REWARD RATIO

| TRADES | RISK OF $100 PER TRADE | PROFIT/LOSS |

| 1 X 300= 300 WIN | 9 X 100 = 900 LOSS | -600 |

| 2 X 300= 600 WIN | 8X 100 = 800 LOSS | -200 |

| 3 X 300= 900 WIN | 7 X 100 = 700 LOSS | +200 |

| 4 X 300=1200 WIN | 6 X 100 = 600 LOSS | +600 |

| 5 X 300=1500 WIN | 5 X 100 = 500 LOSS | +1000 |

What if you are a man taking losses? What if you are a real man that you uses no ego and cut losses quickly? Instead of losing $100, you sometimes lose $75, $50, $80..remember the rule of a day trader?

- Cut losses quick, let your winners run

Note: I know you’re thinking about commission, taxes, broker charges, etc. In this example we don’t mention it, calculate it for yourself.

Value Investing VS Stock Day Trading : Who Wins?

Both wins! But believe me, when you know how to analyze the market using fundamentals and technical analysis, you can combined both value investing and day trading.

That’s how I see it. I used to practice this method in forex trading, and stocks day trading. And it rocks. It works like magic. So, first know your edge by developing a trading strategy and RESPECT AND STRICTLY follow your system come what may, in the long run, you will end up profitable and not on a margin call!

DISCLAIMER: The information provided on InvestmentTotal.com is for general informational purposes only. The content on this website is not intended to be, and should not be construed as, professional financial advice.