Gold has been the best and longest representation of money in the world. That’s why it’s called a precious metal. There are so many sayings, plays, and verses about it, which makes it an integral part of humanity.

It’s so important that it’s even mentioned several times in the Bible. A gold rush today would be the same as a gold rush thousands of years ago, with people losing their minds trying to make a fortune and change their lives overnight.

The first and ultimate function of gold as a monetary currency is that it’s widely accepted as a medium of exchange. Everyone wants to be able to buy what they need today, tomorrow, next week, and a few years down the line. Click here to read more.

Since no one knew what sorts of economic goods would be in high demand at that time, everyone focused on a single one, which was some form of money. Buying small units of gold now and putting them away will give you the opportunity to purchase more things later on. It’s the ultimate marketable commodity because everyone expects it to be valuable in the future. The same thing can’t be said about the dollar.

Units of money are available and valuable today. We need to sell our services or goods in order to increase our supply. For thousands of years, money has been established as the common unit in the economic calculation of every single person. If it didn’t have an exchangeable value, then it wouldn’t serve its primary purpose.

Does money have a price?

We can determine the price of money based on what it was worth yesterday. We have historical records of its purchasing power. If we didn’t have that information, then we wouldn’t be using it at all. A currency without history will not have a future.

Even Bitcoin, which doesn’t have a massive history, recently spiked up in value. When it was first introduced to the world, it didn’t have a price. The first monetary equivalent it had was the price of the electricity used to generate a single unit. Visit this page for more info https://finance.yahoo.com/news/sand-gold-project-advances-malaguit-124558077.html

However, the true revolution started happening when it was used as a medium of exchange to buy two pizzas for it. This is a more recent example, but the same thing has happened in the past.

Before gold, people were using bags of grain, seashells, leather from animals, and even stones as currencies. Even gold didn’t start out as money. The pharaohs in Ancient Egypt were considered to be a gift from the gods, and they coated their jewelry with it. Plenty of religions believed the same and used it as part of their ornaments. That’s how it became widely recognized. It was because it was shiny and lovely to look at.

No one can determine the exact time when precious metals became commonly used as money. It was something that was easy to recognize, and people appreciated its beauty. Since it was a representation of a connection with the gods, people wanted to collect to have a better afterlife or to adorn themselves.

When it became commercial, the marketability aspect started to take off. A precious metals seller never had to beg people to consider buying his goods. Instead, he had to pay for bodyguards to make sure he was safe from thieves and burglars. Even the state couldn’t do anything about the development of this currency.

Additionally, when the state decided to implement a form of money, they just had to say that everyone was required to pay their taxes on it. Taxes are an expense, and there’s no running away from them. Since the state was the ultimate form of power, the unit of account of their choosing could easily become the standard currency in a specific geographic area.

Should you invest in it?

The ultimate machine that decides what’s going to have value in the future is the free market. It’s difficult for a lot of people to understand that this concept works without authority or a committee that oversees it.

Even politicians and states can’t completely influence the market. Knowing what to do to satisfy other buyers is an experiment of trial and error, and gold has been the correct answer every single time. Whenever people meddled with the money supply, the ending was a massive crash. That’s exactly what’s going on with the dollar and the other fiat currencies of the world.

Every single currency in the world is somehow connected to the dollar. Like it or not, the entire world has gotten into a pickle. The only way to survive the pending disaster is to own physical assets, more specifically, precious metals.

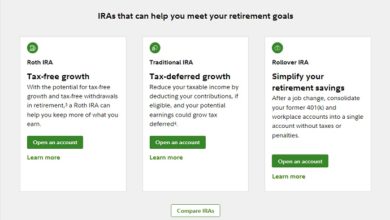

Silver and gold have been the backbones of society for thousands of years, and they are accepted everywhere. This makes them the ultimate asset when it comes to storing value. Most people consider their IRAs to be their best bet against the future, but there’s a way to improve them.

If you don’t have a self-directed IRA from Gold Alliance, it might be wise to consider switching to it. Traditional and Roth IRA types are based on paper assets that are closely related to currencies and fiat money. Whenever there’s depreciation, they’re going to suffer and have a massive correction. Precious metals are always stable, and they’re always trending.

How should you build a portfolio?

A great portfolio can’t be built in a single day. Instead, it’s going to take years of constant work to find what’s right for you. Most experts recommend having 15 to 25 percent of your portfolio in precious physical metals. Depending on your opinion and research for the future, you can choose to increase or decrease that percentage.

Diversification will make it easier for you to handle risk since it’s never wise to put all of your eggs in one basket. Putting part of your income into each asset class is the only way to ensure that your wealth stays untouched or grows over time. Click on this website to find out more.

A few final words

No one knows what the future will hold. That’s why you need to focus on covering every aspect that seems lucrative to investors. But you should never forget about all of the regular folk and what mass hysteria can do. When there’s a crisis, everyone rushes toward gold and silver.

Don’t let savvy experts make you believe otherwise, because you might miss out on one of the best bull markets in your lifetime. A stable and well-distributed portfolio can only be created by having a dollar-cost-averaging strategy where you put a little bit of money each month. That’s going to keep you on track for years to come.

DISCLAIMER: The information provided on InvestmentTotal.com is for general informational purposes only. The content on this website is not intended to be, and should not be construed as, professional financial advice.