Looking for retirement target earning asset for people age 20s? A retirement planning article at InvestmentTotal.com. People on their 20s are busy looking for a great career. They find job and earn their first salary. In this age, some people are looking for some ways to become an entrepreneur. The young entrepreneurs are the one who get rich faster. They are the one who achieved financial freedom at their young age. During this age, people are spending money for their own pleasures and their motto is “enjoy life while still young”.

But, they don’t know being a young has ending. At this age, people are not wise enough to save money for the future. They spend too much as if there is no tomorrow. If you are reading this article and you are still at your 20s, have much time to plan for your future.

Retirement Target Earning Asset for People Age 20s

Learn from 401K

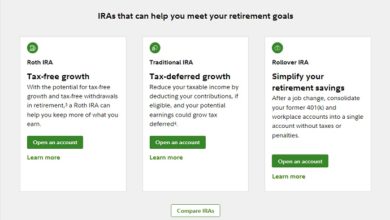

Let us learned from great west retirement services, American employees uses the 401k. There are numerous companies that provides 401K planning in USA. And what is 401K? It is a type of retirement plan offered by the employer, that is what I understand about 401K in United States of America. Here in the Philippines, we call it GSIS, where in government employees has a retirement plan auto deduction from their monthly salary.

How to Plan for Financial Future at Age 20s?

If you are planning to work for life, this article will not be useful for you. But, if you are planning that someday your hard-earned money will take your place to work for you, then, this article is what you are looking for.

The lifestyle in this age is not that expensive compare to a “family man”. This means,you have much money to set aside and save and invest for your future. You have a big chance to become a mega-millionaire or even a billionaire someday, if you are well informed and educated in finances especially in investing money.

The good news is, you are still young. Compound interest favors the young men. If you invest your money for so many years, you will become rich and wealthy. In investing, time and compound interest is our best allies.

Example, if you are 23 today and invest a small amount of money (example: P2,500 per month) in the stock market, mutual funds or UITF(unit investment trust funds) that earns at least 12% per annum and do it within 42 years, you will have an extra P28, 930,784.33 when you reached 65. (23 your age – 65 = 42 years of investing).

Planning your financial future is very easy,however, taking action for that plan requires discipline and courage. You are still young, you might want to enjoy your hard earned money. But be wise, be smart, you have the chance to retire young and rich.

Another Good News for Young Men and Women

Isn’t it Interesting? Yes, however, you need to know how much money you should set aside to invest for your future by determining your retirement target asset. Believe it or not, it doesn’t cost you too much money. Analyze the table below and you will get amazed how small amount of money can give you a fortune.

Retirement Target Earning Asset for People Age 20s

This is just an example of net annual income and cost of life style.

| Age | Retirement Age | Number of Years for Preparation | Cost of Living Per Month |

TEA | Required Monthly Investment |

| 20 | 65 | 45 Years | P20,000 | P21,564,000 | P188.53 |

| 21 | 65 | 44 Years | P20,000 | P20,537,280 | P211.90 |

| 22 | 65 | 43 Years | P20,000 | P19,559,280 | P238.16 |

| 23 | 65 | 42 Years | P20,000 | P18,627,840 | P267.69 |

| 24 | 65 | 41 Years | P25,000 | P22,176,000 | P376.10 |

| 25 | 65 | 40 Years | P25,000 | P21,120,000 | P422.75 |

| 26 | 65 | 39 Years | P30,000 | P24,137,280 | P570.25 |

| 27 | 65 | 38 Years | P30,000 | P22,987,800 | P641.03 |

| 28 | 65 | 37 Years | P30,000 | P21,893,040 | P720.63 |

Considering inflation rates per year. The table above shows the amount of your retirement target asset. Note: InvestmentTotal.com don’t claim that this table is accurate.

Analysis: A 20 year old Filipino that is generating an income of P20,000 per month should invest P188.53 per month within 45 years to acquired his target earning asset of P21,563,00. Compare the monthly investment of a 20 year old man and a 28 year old man. From P188 to P720.63 required monthly investment.

Do not delay investing because if you delay it, your required monthly investment will increase. As the computation above, all data in the last section (required monthly investments) should earn at least 18% annually to get the target earning asset (TEA).

Investment Vehicles that Earns Interest Higher than Inflation Rates

You should invest your money that earns interest higher than inflation rates. There are numerous guides in investing. However you have to follow this guide based on your financial goal. Some guides will teach you to invest in the stock market, some are mutual funds, some are UITFs.

Which Investment Vehicle is the Best for my Retirement?

Which one is the best? You can answer that question yourself, because you are the one who knows your capability in investing especially on taking risk. The higher the risk, the higher the return.

You don’t have to take high risk, the importance is you beat the inflation and achieve your financial goal. And one of these goals is to have your retirement target earning assets, so that, someday, your money will work hard for you.

As a Summary

You have the advantages in investing while you are still young. Investing doesn’t cost you too much money when you are young. A small amount of money can help you achieve financial freedom. While you are still young, you can take as high risk as you can because if something bad happened to the economy, you can easily recover (especially from your financial losses).

If you invest your money during your 20s in 30 years, it simply means you can retire young. You can enjoy your money while you are strong and healthy. Do not delay or procrastinate, today, at your young age is the best time to invest.

Warnings:

Do not invest if you are not sure on what you are doing. Investing introduced you ate your young age, do not forget to ask the financial experts to avoid scams. Ask only the registered financial planner.

Investing Tips:

Set aside money per month, a small amount is enough since your only goal is to acquire your retirement target earning asset. You can invest easily, but investing itself requires knowledge, discipline and courage.

There are many companies or banks offering easy investment program. I am not promoting or endorsing these companies. I am just concern, so that, you may not be a victim of investment scams. As for now, I am investing using the services of financial institutions.I consider these as my retirement accounts.

- For Stock Market Investing: COL Financial Group Inc.

- For Mutual Funds: First Metro Asset Management Inc (SALEF: Save and Learn Equity Fund,Inc.). and Philequity Fund, Inc.

- For UITF Investing: BDO UITF Equity Type on their EIP

The investment vehicle such as mutual funds, UITF and stocks can be the retirement accounts of everyone, even if you are employees, self-employed and business owner. It is easy to invest money nowadays.

Ask yourself how to retire early? Do you have enough to retire early? People who retired early will enjoy their lives in many years compare to those who retired old. If you are at the age of 20’s, here are the tips to acquired your TEA or target earning asset too early.

Take Early Retirement: Best Choice

Extreme Early Retirement Tips: I will never teach you how to get rich fast, or get rich over night. Life won’t work that way. Investing is the best way to retire early. To get your target earning asset, double your monthly required investment so that instead you invest money for so long, you can do it in just few years.

Look at the table, if a 20 years old man wants to retire as a young millionaire in 20 years (at his age 40), then he should invest P3619.09 per month that earns 18% and acquire P6,367,920 after 20 years.

Important: This article is for information purposes only. Do your own investigation and research in investing. Any financial losses shouldn’t be the InvestmentTotal.com author’s liability.

If you can’t afford to invest P5,000 per month, you can still invest small amount and make millions. Read the article of Future Value of P1,000 Per Month Investment.

So, what can you say about this guide for retirement target earning asset for people age 20s? Let me know if you have questions. Use the comment box below.

DISCLAIMER: The information provided on InvestmentTotal.com is for general informational purposes only. The content on this website is not intended to be, and should not be construed as, professional financial advice.