It’s never too early or too late to start saving for the future. Whether that future is six months from now when you go on holiday or in thirty years when you retire; saving will always be beneficial.

And it’s not just about saving. Good financial planning can mean the difference between an enjoyable retirement and a lifestyle you can’t afford. It can help you prepare for unexpected events, avoid surprises with your tax returns, and let you know if your finances are heading in the right direction.

Well-planned finances can also make a huge difference to your family because it can help you make the right decisions for them too.

It’s never too early or too late to start saving for the future.

But it’s not easy. There are a lot of questions to answer and a lot of numbers to crunch. In fact, financial planning can seem as difficult as solving a maths problem.

That’s why we created this checklist. It’s a great starting point for financial planning, and it can help you get on top of your finances.

Four Considerations for Developing Short and Long-Term Financial Plans

1. Find the Right Savings Account

If you’re saving for the short-term, like a holiday or an emergency, you need a high yield savings account that keeps your money safe and gives you the best interest rates.

To find the right savings account, you need to think about:

- How much money you need to save.

- When you need to start making withdrawals.

- How often you want to make withdrawals.

You can’t just select any savings account and expect to get the best interest rates. For example, if you’re saving for a holiday and want to make withdrawals every day or two, you need an account that lets you do that.

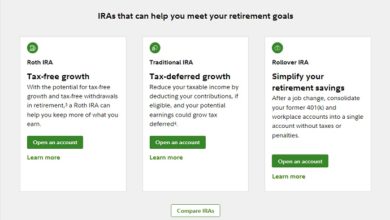

Or, if you’re saving for a long-term goal, like retirement, you need to consider your future needs. You can’t save money in a savings account for ten years, then transfer it to a term deposit when you retire. That’s because term deposits give you a better interest rate on your money, but you can’t access it until the term is up.

So, think about what your future needs are, and what you’ll need the money for. Then find the savings account that matches up best.

2. Plan Your Budget

If you’re saving for the long-term, you need to plan your budget. You can’t just save for retirement and then not think about the future.

Once you’ve figured out how much money you need for retirement, you need to know how much you need to save each month to reach that goal. And you need to think about how to invest your money so it grows over time.

A budget helps you plan for the future. It helps you save more than you spend. It helps you spend less than you earn. It helps you take control of your finances.

3. Consider Your Investment Options

If you’re saving for the long-term, you should consider your investment options.

Most people don’t have time to research stocks or understand complex investment strategies. The best thing you can do is to put your money into a low-cost investment that will give you the best returns over the long-term.

4. Think About Your Tax Situation

If you’re saving for the long-term, you need to think about your tax situation. Your savings should be invested in a way that minimises the tax you will pay when you come to withdraw the money.

For example, you should avoid withdrawing money from your savings account when you’re in a high tax bracket. That’s because you’ll pay tax at your marginal tax rate, which means you’ll pay more tax on the withdrawal.

You should also consider how you withdraw the money. If you withdraw the money over a period of time, you may pay less tax that way.

Make sure you understand how your investments are taxed, what you pay in tax on the investments, and how you pay the tax. It’s one of the most important parts of long-term financial planning.

To Sum Up

There are a lot of questions to answer and a lot of numbers to crunch if you want to prepare for the future.

But it’s worth it. A good financial plan can help you save for the future, prepare for unexpected events, and make the right decisions for your family.

It makes sense to plan your finances. It’s never too early or too late to start.

DISCLAIMER: The information provided on InvestmentTotal.com is for general informational purposes only. The content on this website is not intended to be, and should not be construed as, professional financial advice.