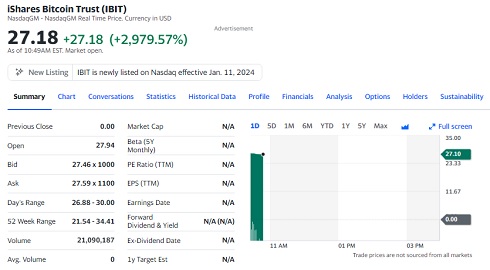

BlackRock’s $IBIT Bitcoin ETF has displayed remarkable resilience, boasting an impressive 25% surge in value against a backdrop of $2 million in trading volume. This robust performance not only underscores investor confidence but also signifies a burgeoning interest in Bitcoin-related financial instruments.

As the ETF continues to capture market attention and foster increased trading activity, it becomes a focal point for analysts seeking insights into broader trends within the cryptocurrency sphere. The sustained traction of this ETF underscores the evolving maturity of the market, with major institutional players like BlackRock actively engaging, injecting both credibility and liquidity into the Bitcoin investment landscape.

Despite the positive momentum, investors are urged to exercise vigilance and conduct thorough due diligence. Cryptocurrency markets, known for their inherent volatility, demand a judicious approach. While the current success of the $IBIT ETF is encouraging, historical performance does not guarantee future outcomes. Staying abreast of regulatory shifts and monitoring the evolving sentiment surrounding cryptocurrencies will be pivotal in gauging the long-term sustainability and reliability of such investment instruments.

The top institutional holders of the mentioned asset as of December 30, 2022, are as follows:

- Jane Street Group, LLC holds 12,355 shares, representing 41.18% of the total outstanding shares, with a corresponding value of $334,821.

- Susquehanna International Group, LLP holds 11,237 shares, accounting for 37.46% of the total outstanding shares, with a value of $304,523.

- UBS Group AG holds 417 shares, constituting 1.39% of the total outstanding shares, with a value of $11,300.

The noteworthy ascent of BlackRock’s $IBIT Bitcoin ETF reflects an escalating interest in cryptocurrency exposure within traditional financial arenas. Yet, a prudent and well-informed strategy remains imperative, acknowledging the risks inherent in the dynamic and ever-evolving cryptocurrency landscape.

Source/Reference: https://finance.yahoo.com/quote/IBIT?p=IBIT

Bitcoin Exchange-Traded Fund (ETF)

A Bitcoin Exchange-Traded Fund (ETF) is a type of investment fund that tracks the price of Bitcoin, the popular cryptocurrency, and aims to provide investors with exposure to Bitcoin without requiring them to directly hold or manage the cryptocurrency themselves. The ETF structure allows investors to buy and sell shares of the fund on traditional stock exchanges, making it a more accessible and familiar investment vehicle for many.

Here’s how a Bitcoin ETF generally works:

- Fund Structure: The ETF is structured as a fund that holds Bitcoin as its underlying asset. Instead of owning the actual Bitcoin, investors own shares or units of the ETF.

- Market Trading: These ETF shares are traded on stock exchanges, just like traditional stocks. Investors can buy and sell these shares throughout the trading day at market prices.

- Tracking Index: The performance of the Bitcoin ETF is typically designed to closely track the price movements of Bitcoin itself. This is achieved through various financial instruments and derivatives.

- Custody and Security: The ETF provider or manager is responsible for securely holding the actual Bitcoin that backs the fund. They often use reputable custodians to ensure the safe storage of the cryptocurrency.

- Accessibility: Investing in a Bitcoin ETF provides a convenient way for investors to gain exposure to Bitcoin without dealing with the complexities of managing private keys or setting up digital wallets.

- Regulation: The operation of Bitcoin ETFs is subject to regulatory oversight. Different jurisdictions may have different regulatory requirements for the approval and operation of cryptocurrency-related financial products.

The introduction of Bitcoin ETFs has been seen as a significant development in the financial markets, as it provides a more regulated and mainstream way for traditional investors to participate in the cryptocurrency space. It offers potential benefits such as liquidity, transparency, and ease of trading, while also addressing some of the concerns associated with directly holding and securing Bitcoin. It’s important for investors to conduct thorough research and consider the risks before investing in any financial product, including Bitcoin ETFs.

How to Invest Money in Bitcoin ETF

Investing in a Bitcoin Exchange-Traded Fund (ETF) involves a process similar to investing in traditional ETFs. Here’s a step-by-step guide on how to invest in a Bitcoin ETF:

Open a Brokerage Account:

To invest in any ETF, including a Bitcoin ETF, you need to have a brokerage account. Choose a reputable and reliable brokerage platform that supports the trading of ETFs.

Research and Choose a Bitcoin ETF:

Conduct thorough research on available Bitcoin ETFs. Look for factors such as the fund’s performance, expense ratio, management team, and any additional features. Choose the ETF that aligns with your investment goals.

Fund Your Account:

Deposit funds into your brokerage account. Ensure that you have sufficient funds to make the desired investment in the Bitcoin ETF.

Search for the ETF Ticker:

Find the specific ticker symbol associated with the Bitcoin ETF you want to invest in. This information is necessary for placing a buy order.

Place a Buy Order:

Using the trading platform provided by your brokerage, place a buy order for the chosen Bitcoin ETF. Enter the ETF ticker symbol, the number of shares you want to purchase, and any other relevant details.

Review and Confirm:

Before confirming the order, review all the details to ensure accuracy. Confirm the buy order when you are satisfied.

Monitor Your Investment:

Once your buy order is executed, monitor your investment regularly. Keep track of the performance of the Bitcoin ETF, market trends, and any relevant news that might impact the cryptocurrency market.

Consider a Long-Term Approach:

Bitcoin and cryptocurrency markets can be volatile. If you’re investing with a long-term perspective, consider holding your investment through market fluctuations rather than attempting to time short-term movements.

Stay Informed About Regulations:

Stay informed about regulatory developments, as changes in regulations can impact the cryptocurrency market and the operation of Bitcoin ETFs.

Secure Your Investment:

If your broker allows it, consider using security features such as two-factor authentication to enhance the security of your investment account.

Remember that investing always carries risks, and the value of Bitcoin and other cryptocurrencies can be highly volatile. It’s advisable to do thorough research, diversify your investment portfolio, and, if needed, consult with financial professionals before making investment decisions. Regulations and the availability of Bitcoin ETFs may vary based on your location, so be aware of any legal considerations in your jurisdiction.

DISCLAIMER: The information provided on InvestmentTotal.com is for general informational purposes only. The content on this website is not intended to be, and should not be construed as, professional financial advice.