Pros and cons, advantages and disadvantages, everyone wants to give you financial advice. Friends and family, employers and co-workers, everyone’s an “authority.” Ever since they invented the IRA and the Roth IRA, people have been confused.

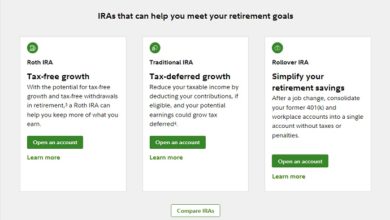

If you have had a traditional IRA for some time, you might want to switch to a Roth IRA. If you are rolling funds out of a 401(k) Plan, you might want to move to a Roth IRA. And, if you want to start saving for retirement or education, you might opt for a Roth IRA instead of the traditional route.

As Kiplinger reports, “If the savings power, flexibility, and tax-free status aren’t enough to persuade you of Roth’s virtues, Uncle Sam throws in a few extra perks” like being able to withdraw to finance your first home or your child’s education.

3 ways to convert:

1. Account to account: If you have you want to move your traditional IRA to a Roth IRA within the same bank or institution, it’s a matter of customer service. You just ask them to designate the IRA as a Roth.

2. Trustee to trustee: One financial institution or brokerage firm will help you convert your traditional IRA from their management to a Roth IRA at another institution.

3. Self to self: If leave and employer and close out your 401(k) IRA, you open a Roth IRA with that check. But you must make the conversion with 60 days.

But why bother?

The traditional IRA is a pretax deal. The fund manager deposits your contribution before taxes are calculated. As long as you follow the rules and regulations, you don’t pay taxes on the investment or its growth until you withdraw the money. If you wait until your retirement years, most people find themselves in lower tax brackets.

When you invest in a Roth IRA, you do so with after-tax dollars. That is, your deposit is taxed in the year the money is earned and contributed, and that means you won’t pay taxes when you take the money out or fund your retirement. If you convert assets from your traditional IRA, you will pay taxes on it before you deposit it in the Roth.

Understanding an IRA and its mechanics will help you make the right decision. A Roth IRA is right for you:

- If your income exceeds the IRS limits on the IRA and you think you’ll be in a higher tax bracket in retirement years;

- If the total of this year’s income and the amount to be converted does not launch negative tax consequences;

- If your current IRA has recent losses, you’ll pay less in income taxes; and

- If you convert funds any time this year, you won’t pay the required taxes until next year’s filing deadline.

A final tip!

Forbes advises, “If it all feels a bit overwhelming, find a good financial advisor who can help you set up a plan and invest for your future with a Roth IRA.”

DISCLAIMER: The information provided on InvestmentTotal.com is for general informational purposes only. The content on this website is not intended to be, and should not be construed as, professional financial advice.