What Are Capital Gains Taxes?

A capital gains tax comes into play when the value of an investment is gained due to the sale of assets. If an investor sells an asset, it is said to have been “realized.” Stock shares and other investment opportunities will not be charged capital gain taxes until they are sold. There are multiple ways to overcome capital gains tax, including seeking qualified opportunity zone funds near me.

9 Proven Ways Investors Can Reduce Their Capital Gains Tax Liability

Most investors are constantly looking for strategies to help them reduce their capital gains tax liability. The following offers information on helping investors reduce their tax liability with proven methods.

- It is important investors make use of their CGT allowance. Every individual has a certain CGT allowance each year. This allowance allows an investor to make a certain amount of gain free of taxation.

- If an investor’s overall gain exceeds their annual allowance, it can be wise for them to make use of their losses by selling some assets at a loss. By doing this, investors can reduce or even eliminate their capital gain tax liability.

- It can also be helpful to transfer assets to a spouse or civil partner. Investors need to know transfers to spouses are currently exempt from capital gains taxation.

- Bed and breakfasting was once a helpful way of reducing capital gain taxes. Investors would sell shares that had a gain and buy them back the very next day. Now that this practice is no longer allowed, many investors go through the same process but allow their spouses to buy back the assets for them. Today, this practice is called “Bed and Spouse.”

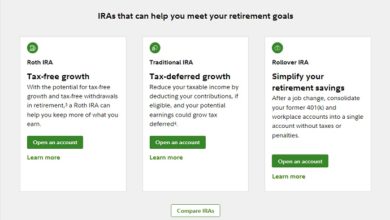

- Investors can also reduce their tax liability by contributing to a pension. Capital gain tax liability can be reduced significantly by pension contribution.

- Individuals who want to reduce their tax implications can also donate to charity. Income tax relief is available to those who give assets to a charity at less than the market value.

- Investing in an enterprise investment scheme is also a proven way to reduce capital gains tax. If held for three or more years, these investments are free of capital gains taxes.

- On certain assets, individuals are offered holdover relief. When holdover relief is claimed by an individual, their tax liability is postponed.

- There are certain assets that are called chattels. Chattels, such as antiques and collectibles, are tax-free.

Choosing the Right Investment Strategy Is Critical

To avoid capital gains tax liability, individuals need a clear-cut investment strategy that will help them minimize their tax implications. Getting help from an opportunity fund is wise.

Although capital gains taxes are historically low, as of now, this does not mean taxation is inexpensive. It is important individuals exercise their options and learn as much as possible about the methods they can use to reduce their tax liability.

Conclusion

The sale of assets will often lead to tax implications for individuals. By using the proven tips above, individuals can reduce their tax liability significantly or even entirely. Taking the initiative to use these tips can make a big difference in your tax bills each year.

DISCLAIMER: The information provided on InvestmentTotal.com is for general informational purposes only. The content on this website is not intended to be, and should not be construed as, professional financial advice.