The guide in saving for retirement in your 20s and the benefits of saving early. Planning for retirement in your 20s? Well, that’s great news! Rare people are planning for their retirement when they are young. The question is, how can you do the retirement planing in your 20s if in reality is “very hard”.

The lifestyle of a young man is very different from the lifestyle of a old and family man. In your 20s, you can enjoy your life to the fullest. You can spend all your salary because you have no obligations to other people like your spouse and kids.

Since you are still young, you need to combat the wrong mindset about retirement planning. And what is the wrong mindset? Many young men and women think that retirement planning is only for old men and women. They think that retirement should only be plan when they have family or when they are in near to leave the workplace.

Saving for Retirement in Your 20s – the Real Deal

The real deal is, if you sacrifice to save money while you are still young instead of just enjoying your life all year round. You will retire young and retire rich.

Imagine the money you can accumulate if you will start saving for retirement in your 20s. Actually, again, the real deal is, don’t just save, but, invest.

Investing in Your 20s

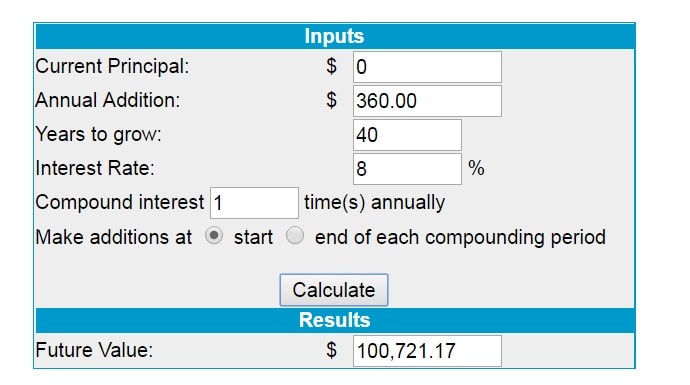

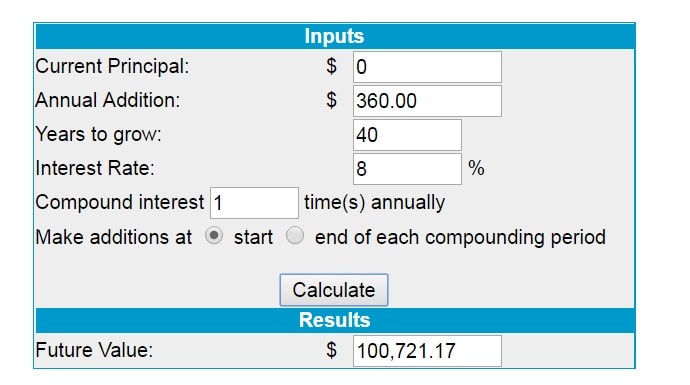

I will give you an example about the money you can accumulate by investing $30 per month in an investment that earns at least 8 percent per year. Compare this table as if you will start investing too late.

- Monthly Investment: $30 or $1 per Day

- Yearly Investment: $360

- Years Investing: 40 Years

- Earned Interest Per Year: 8 Percent

Start Investing Early Preferably in Your 20s

If you will start investing in your 20s with only $1 per day or $30 or $360 per year that earns at least 8 percent interest rate per year within 40 years (or when you’re 60 years old), you will have a retirement savings amounting to $100,721.17. Note, that this future value was calculated without the tax.

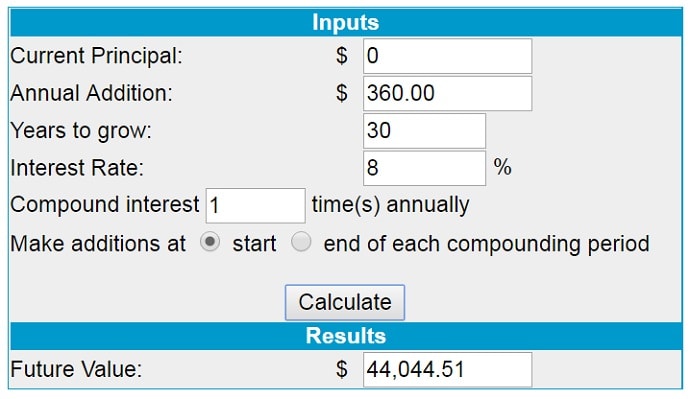

Imagine if you will invest in your 30s. That’s 10 years late. using the same amount, same interest rate earned (8 percent) but this time the investment horizon is only 30 years.

If You will Invest 10 Years Late Instead of Investing in Your 20s

Your $360 per year investment within 30 years or during your retirement at 8 percent interest rate is amounting to $44.044.51. Imagine that? Instead of having hundred thousand dollars as your retirement savings, you will only have 44 thousand dollars.

How to Save for Retirement at 20?

Starting a retirement fund is easy. Just open an investment account. Invest in stocks or mutual funds. Try to search the best mutual fund companies in your countries or the best stock brokerage firms. Open one and make this account as your retirement account.

In United States, the popular retirement account is IRA. What is IRA? IRA simply means Individual Retirement Account. It was created for Americans as a tool to save for retirement.

Maybe you asked, I can’t save at age 20. Saving for retirement at 25 will be easy for me because that time, I got a job. That’s a good question. I don’t think you can’t set aside $1 even though you are still student at age 20. $1 is enough for you to start saving for retirement at 20s.

Tips and Warnings

We all know that at 20s we have no many obligations like families. This is the great time to save for retirement because you can easily set aside money.

balance your lifestyle. You can enjoy your life at 20s and at the same time preparing your retirement years. Your financial future always depends on what you are doing on your finances today.

Whenever you can, save money while you are young. Saving for retirement in your 20s is better than saving late! Any comments, reactions or ideas? Leave a comment below. Your opinions are highly appreciated. Thanks!

DISCLAIMER: The information provided on InvestmentTotal.com is for general informational purposes only. The content on this website is not intended to be, and should not be construed as, professional financial advice.