Here’s how can you identify your retirement savings by age. This page will guide you on how to know how much money to save or invest to have enough retirement funds.

If for example you are at age 25 earning $20,000 per year. If you decide to retire at age 60, you still have 35 years preparation. The question now is how much money should you set aside to put in your retirement savings every month?

Knowing your goals can be useful. If your retirement target earning asset at the age of 60 is $200,000. That means your earning asset should at least earn 10% interest rate per year to earn $20,000 which is your current yearly income.

Knowing Retirement Savings by Age Easily

Did you get my point? The point here is to acquired enough assets that earns passively for you. That way, if you know your retirement savings goal, you can easily identify your retirement savings by age.

Example:

If you are now 35 years old having a $100,000 annual income. What is your target earning asset when you retire. If you decide to retire at 65, how much should you save per year for retirement?

Sample Calculation

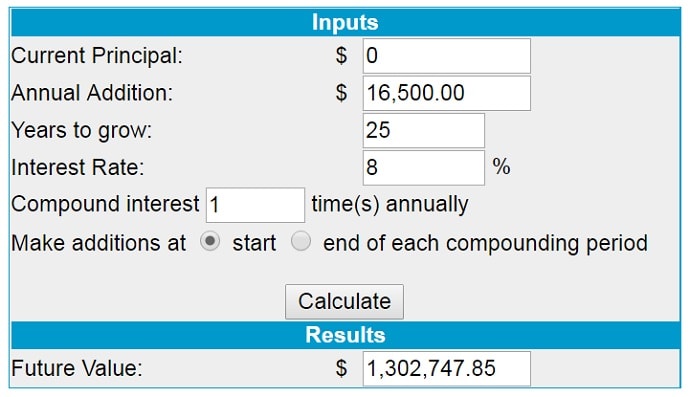

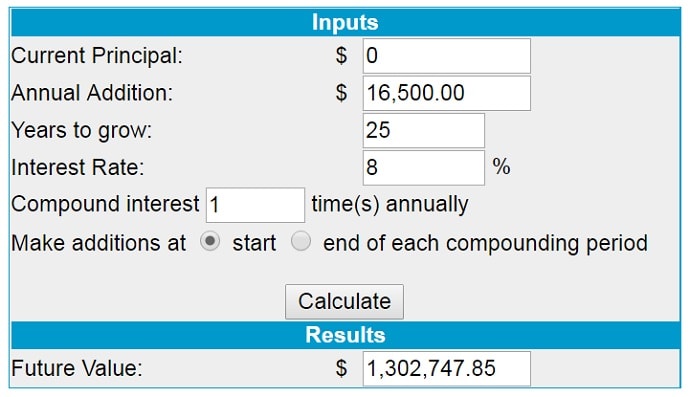

When you reached age 65, you should have $1,300,000 earning asset. How to accumulate that savings? First, calculate how many years or months (investment horizon) you still have. Second, identify the monthly or annual investment. (See this table)

Knowing Your Retirement Savings by Age

At the age of 35, if your annual income is $100,000 and you want to earn the same amount at the age of 65. You need to save $16,500 per year within 25 years (your investment horizon) that earns at least 8% interest rate per year.

Answer: $1,302,747.85 X .08% = $104,219 (equivalent to your current annual income)

You still have 25 years preparation, right? But how does your retirement savings compare when your age changed? Simple, the moment you start planning for your retirement should be the first basis on how much money should you invest per month. Unless you want to change your retirement target earning asset.

Retirement Savings Comparison

Also, if in case you start lately, your monthly retirement savings will also changed. if yuo invest $16,500 per year in 15 years (because you invest too late) you will only have $483,850.67 as if your savings is earning 8 percent.

Your savings will last in your retirement as long as it is earning for you. That’s why as I have mentioned in the beginning of this page that the idea is “you should have enough money to work for you”. A passive income during your retirement.

Few people knows about it. Most people don’t know how to make their money work for them. In Retirement Planning IQ.com previous post, I have mentioned Robert T. Kiyosaki secret about retiring young and rich.

The faster you accumulate your target earning asset, the faster you can retire. But, the first thing to do now is to know your retirement target earning asset. Now you know how to identify your retirement savings by age in a simplest way! Any ideas or opinions about this matter? Feel free to add them in the comment box below.

DISCLAIMER: The information provided on InvestmentTotal.com is for general informational purposes only. The content on this website is not intended to be, and should not be construed as, professional financial advice.