A reader asked a question yesterday April 29, 2015

“How many credit cards do teens like me need? I am still student from Florida, USA. I want to know how many credit cards do I really need and what type of credit card should I get. “

Applying for a credit card is very easy, however you need to know the types and the real use of having a credit card.

Maybe he wants to use a credit card to purchase the stuff conveniently. I hope this teen knows the common requirements in applying for a credit card and be informed on how to find the lowest interest rates credit card.

There are many teens today who are not responsible for their own actions. Even when we talk about personal finances, they are not familiar on how to handle money and spend money wisely.

They just want to buy new stuffs for their selves. Parents should educate and train their children how to manage their own finances before they allow them to use credit cards.

Sometimes it is practical to get your child a debit card than issued him/her a credit card. As I have said awhile ago, teens are not familiar with personal finance.

They aren’t aware what’s the risks in using a credit card. If you give them permission to use a debit card, you don’t have to worry how much they spend because the load of the debit card is what can they able to spend.

Example; if you load your child’s debit card a $200, he can only spend not more than $200. You can limit the spendings of your child when he wants to buy stuffs.

That’s the good thing about debit card. If you are a teen and really want to have a credit card not debit card, here’s the simple guide.

Ask Permission from Your Parents

First, you need to ask permission to your parents since you are still a student. It means your parents are liable for every bills. Unless you want to pay it for yourself, you can apply for a part time job while studying.It is possible that your credit application may denied or rejected.

Anyway, there’s no harm in trying. You can apply to as many bank if you want, if you get approved for one bank, grab it and forget the rest.

Personal or Student Credit Card

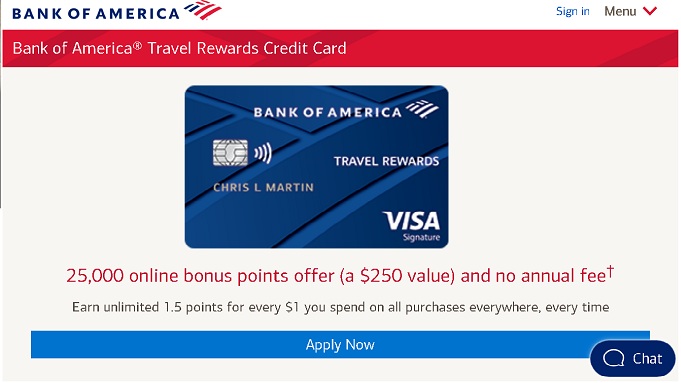

You can apply for a personal credit card. Some banks offer student credit card. Try to analyze the difference between one. As much as possible, apply for a credit card with no annual fee and offers only at a low interest rate.

When applying for a credit card, your parents will help you for your application. It will be very easy to get approved when your parents meet the necessary requirements and qualifications.

As a Summary:

To answer the simple question, a student who wants a credit card should ask permission to his parents. Determine which credit card do he really needs. Sometimes a debit card is more convenient for teens than using credit card.

However, if a teen insist to have a credit card, one card is enough. Choose credit cards with no annual feel. Just ask your parents to increase the limit of your credit card. If you think this answer is useful. You can share it to your friends now. Thanks!

DISCLAIMER: The information provided on InvestmentTotal.com is for general informational purposes only. The content on this website is not intended to be, and should not be construed as, professional financial advice.