GM Stock Dividend

Understanding GM Stock Dividend: What Investors Should Know

GM stock dividend is crucial for investors interested in this company. General Motors (GM) is a well-known name in the automotive industry. Dividends are portions of a company’s earnings distributed to shareholders, offering them a return on their investment without needing to sell shares.

GM Stock Dividend History

Over the years, the GM stock dividend has had a varied history, influenced by economic conditions and the company’s financial performance. GM reinstated its dividend in 2014 after its bankruptcy and subsequent restructuring during the 2008 financial crisis. The company provided consistent dividends until the COVID-19 pandemic in 2020, when GM, like many others, suspended its dividend to conserve cash during economic uncertainty.

Dividend Resumption and Current Status

In August 2022, GM resumed its dividend payments after a two-year hiatus, reflecting confidence in its financial stability and future prospects. As of the latest update, the GM stock dividend is $0.09 per share each quarter. While this is lower than pre-pandemic levels, it demonstrates GM’s commitment to returning value to shareholders while also investing in its transition to electric vehicles (EVs).

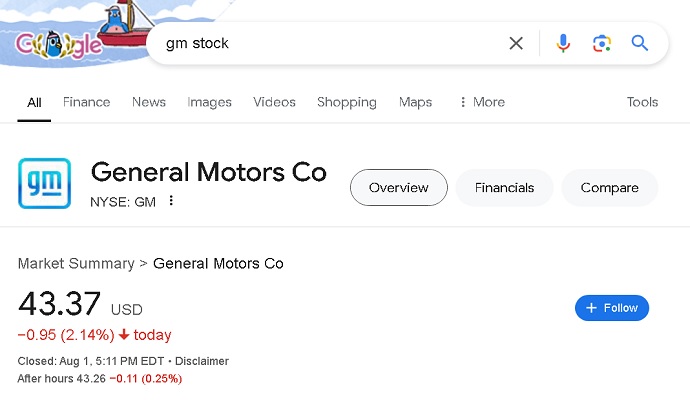

Update: The current dividend yield is 1.1%, with a payout ratio of 5%. This is below the industry average yield of 2.4%. The next dividend pay date is set for September 19, 2024, with an ex-dividend date of September 6, 2024. The dividend per share stands at $0.480, while the earnings per share (EPS) are $9.79. Looking ahead, the dividend yield is forecasted to increase slightly to 1.3% over the next three years.

What to Consider as an Investor

- Yield vs. Growth Potential: The GM stock dividend yield may be attractive, but investors should balance this against the company’s growth potential, especially in the evolving EV market. It’s important to decide whether steady income from dividends or capital appreciation from GM’s expanding EV offerings is more appealing.

- Financial Health: GM’s ability to sustain and potentially increase its dividend depends on its financial performance. Key metrics to watch include revenue growth, profitability, and cash flow, particularly as GM invests in EV technology and infrastructure.

- Market Conditions: External factors like economic conditions, interest rates, and consumer demand for vehicles can impact the GM stock dividend. A downturn in the automotive market could affect GM’s ability to maintain its dividend.

Conclusion

The GM stock dividend is a key aspect for investors to consider. While the current dividend yield offers steady income, GM’s long-term potential, especially in the EV sector, presents opportunities for growth. Staying informed about GM’s financial performance and broader market trends is essential for making sound investment decisions.