Should I get a loan to to invest in stocks, mutual funds, forex or start my own business? The answer to the question; Should I get a loan to to invest will discuss in this page. An open question & answer discussion about investing & getting a loan as an investment capital. If you will get a loan and use the borrowed money as your investment capital, you are taking advantage of leverage investing. Applying for a loan is easy as long as you are qualified and completed the required documents. However, you must understand that when getting a loan, a clear purpose for the borrowed money is very important.

Will you use the borrowed money to build a house, to buy a car or use a loan to invest. Getting a loan and make the borrowed money as your investment capital is very risky but very rewarding. In our previous topic, we said that financial leverage can help investors make easy money. How does it work. Since the investors aren’t pulling money from their own pocket, they use other people’s money to make money.

Should I get a loan to invest? Think about your investment capital, if you have no capital or your capital is not enough, try to borrow money.

Especially if you have limited resources (investment capital), loans are very useful to have immediate capital for your business or for your investments.

Should I Get a Loan to Invest?

Before we continue this short discussion, let us first answer the question “should I get a loan to invest“. First, as I have said, getting a loan is very easy but be sure to have a clear purpose to where to use your loan.

Should I Get a Loan to Invest: Understanding Loan Interest Rate

Second, you should understand that a loan has corresponding interest rates from 0.50% to 1% above per month. If you can earn more than the loan interest rate, then it is a great idea to invest your borrowed money.

What we really mean is that if you invest in a vehicle that earns 10% per year and the interest rate of your loan is just 7% per year, you are earning 3% from other people’s money. As simple as that.

Tips and Warnings: Should I Get a Loan to Invest?

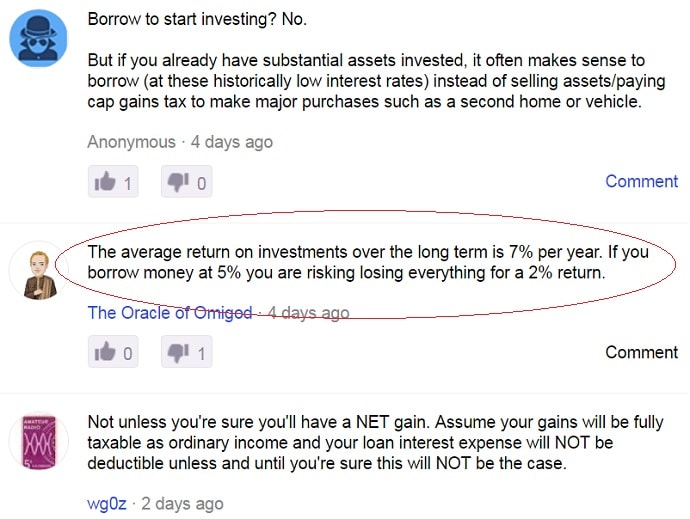

Let me share to you what I read in Yahoo answers…Here is what I got;

Borrow to start investing? No.

But if you already have substantial assets invested, it often makes sense to borrow (at these historically low interest rates) instead of selling assets/paying cap gains tax to make major purchases such as a second home or vehicle.

- Before you apply for a loan, complete the required documents such as business permits, bank account, assets, government valid ids, etc.

- Don’t invest the borrowed money if you are not sure on what you’re doing.

- Always remember that investing your loan is very risky, but, it is rewarding.

- Analyze the risk before you invest especially if you will only use borrowed money as your investment capital.

- When you invest the borrowed money, be sure that your investment is earning higher than the loan interest rate.

- Find a loan low interest rates in the bank or other financial institutions (lending companies). Do not forget to compare their interest rates and apply a loan to the one that offers low interest rates.

Should I Get a Loan to Invest? – Learn More First

Learn more about leveraging before you get a loan to invest. As an inspiration and take home advice, do you know that leveraging money is the number one trick of rich and successful people? Try to get a loan to invest but be wise enough to cover the loan interest rate when you invest.

Let me know what you think about our answer to the question “should I get a loan to invest“. Share your thoughts, opinions and investing tips. Leave a comment below.