What is the IRS Installment Plan?

The IRS installment plan is a method that allows taxpayers to pay off their tax debt in smaller, manageable payments over time. Instead of paying the full amount owed at once, taxpayers can break it down into monthly payments. This plan is helpful for those who can’t afford to pay their taxes in one lump sum.

The IRS installment plan is an agreement between the taxpayer and the Internal Revenue Service. It sets up a timeline for payment and includes a fixed monthly amount. This plan can be applied for online, over the phone, or by submitting a specific form.

The IRS offers different payment options based on the amount owed and the taxpayer’s ability to pay. These plans come with interest, which adds to the total amount owed over time.

Key Takeaways

- The IRS installment plan helps taxpayers manage their debt with monthly payments.

- You can apply online, by phone, or by mailing IRS installment agreement forms.

- Interest and penalties may apply.

- Different plans are available based on your ability to pay.

Types of IRS Payment Plans

The IRS offers two main types of installment plans: short-term and long-term.

IRS Short-Term Payment Plan

The IRS short-term payment plan is designed for taxpayers who owe a smaller amount. With this option, you can pay off your balance within 180 days. Interest rates still apply, but this plan is quicker and often cheaper than a long-term option.

This plan is ideal for those who expect to pay their taxes in less than six months. You can apply for this plan online through the IRS payment plan login, or you can call the IRS directly.

Long-Term IRS Payment Plans

For those who need more time, the IRS long-term installment plan spreads payments over a more extended period. This plan is usually set for 72 months (6 years), but the exact duration depends on the amount owed.

This type of plan requires a detailed review of your financial situation. The IRS will consider your income, expenses, and assets before agreeing to a long-term payment arrangement.

Applying for an IRS Installment Plan

You can apply for an IRS installment agreement in several ways, including online, by phone, or by mail. Here’s how:

IRS Payment Plan Online

The easiest way to set up a payment plan is through the IRS website. You can log in using the IRS payment plan login to start the application. Once you’re logged in, you can follow the steps to submit your payment plan request.

IRS Payment Plan Phone Number

If you prefer, you can apply by calling the IRS payment plan phone number at 1-800-829-1040. Customer service representatives will guide you through the process.

IRS Installment Agreement Form

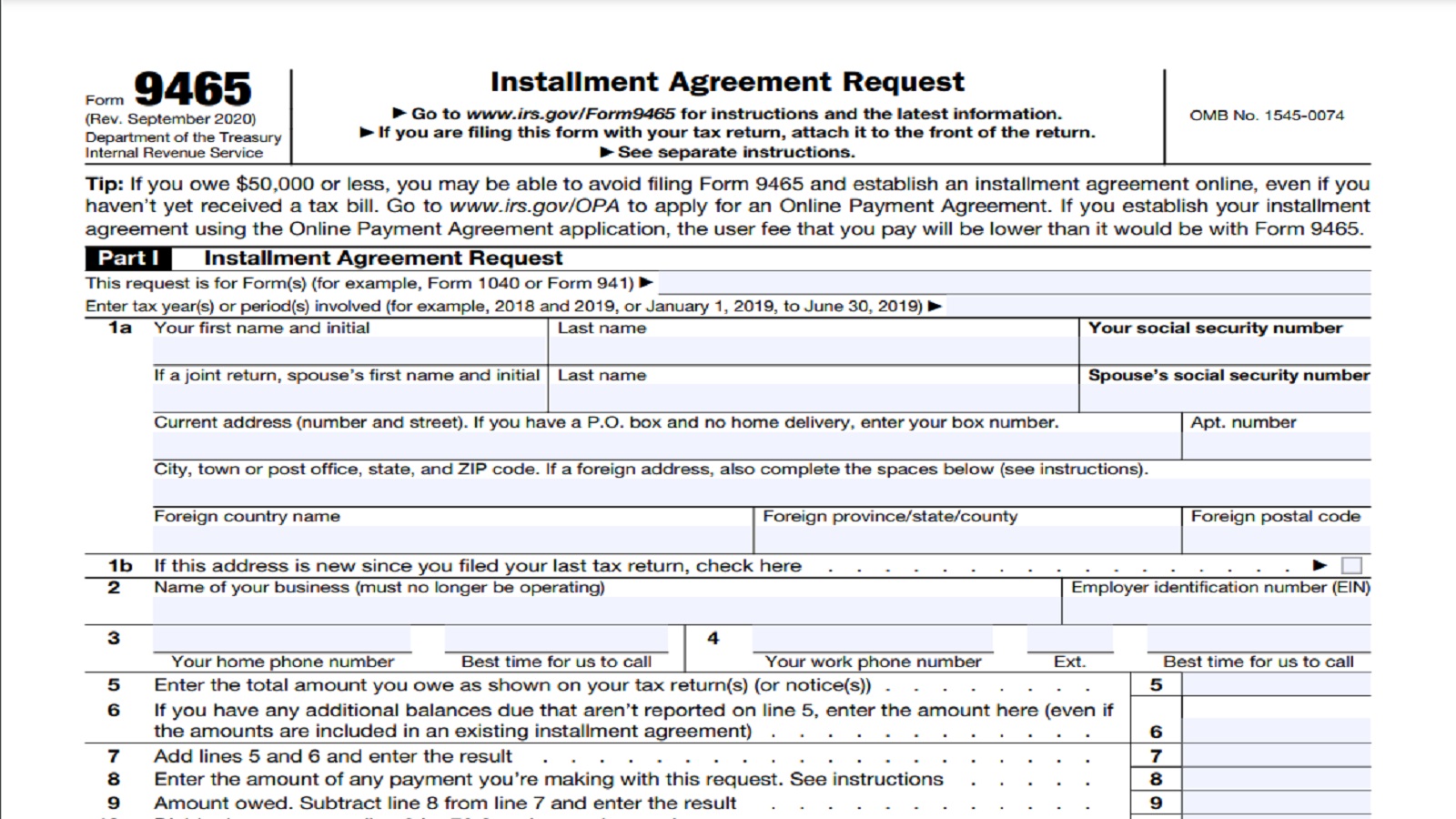

You can also fill out IRS installment agreement form 9465. This form is available online as a PDF. Once completed, you can mail it to the IRS. This option takes longer but is still a valid way to apply.

IRS Payment Plan Calculator

The IRS payment plan calculator can help you estimate what your monthly payments will be. This tool calculates how much you can afford to pay based on your income, expenses, and the total tax debt.

Using this calculator gives you an idea of what to expect before committing to a plan. It helps ensure you choose a plan that fits your budget.

IRS Payment Plan Interest Rate

The IRS charges interest on unpaid taxes, even if you set up a payment plan. The interest rate is based on the federal short-term interest rate, plus an additional 3%. This interest adds to your total debt, making it important to pay off your balance as quickly as possible.

The IRS payment plan interest rate is applied to your remaining balance each month. While the plan helps you avoid immediate penalties, the added interest can make the total cost higher in the long run.

Benefits of an IRS Installment Plan

The IRS installment plan offers several advantages to taxpayers who cannot afford to pay their taxes in full.

Avoiding Penalties

If you set up a payment plan, you avoid many penalties that apply to unpaid taxes. Although you still pay interest, the penalties for not paying your taxes can be much higher.

Managing Finances

The payment plan gives you the flexibility to manage your finances. Instead of paying one large lump sum, you can break it down into smaller amounts. This makes it easier to stay on top of your payments without causing financial strain.

Keeping Your Account in Good Standing

Setting up an IRS installment plan keeps your tax account in good standing. As long as you make your payments on time, you won’t face collections or other legal actions.

Calculating Monthly Payments

Let’s go through a quick example of how monthly payments are calculated using the IRS payment plan calculator.

- Let’s say you owe $10,000 in unpaid taxes.

- The IRS allows you to pay this off over 72 months (6 years).

- The IRS charges an interest rate of 6%.

To calculate your monthly payment, you would divide the total amount owed by the number of months in the plan and add interest. In this case:

$10,000 ÷ 72 = $138.89 (base payment)

Now, factor in the interest:

$138.89 × 1.06 = $147.22 per month

This means your monthly payment would be about $147.22, and the total cost over six years would be higher than the original $10,000 due to interest.

How to Stay on Top of Your IRS Installment Plan

Once you set up an IRS installment plan, staying on top of your payments is crucial. Missing payments can result in additional fees and penalties. To avoid this:

- Set up automatic payments if possible.

- Use the IRS payment plan login to track your payments online.

- Keep track of due dates and pay on time to avoid penalties.

Adjusting Your IRS Installment Plan

If your financial situation changes, you may need to adjust your payment plan. You can request a modification by contacting the IRS. They will review your case and may agree to lower payments or extend the payment period.

Modifying your plan can prevent default if you struggle to meet your current payment amount.

The Bottom Line

The IRS installment plan is a practical solution for managing tax debt. By allowing you to pay off taxes in monthly installments, it helps prevent financial strain while keeping your account in good standing. Whether applying online, by phone, or by mailing the form, this plan can provide flexibility. Always consider the interest rates and payment terms before deciding on the best option for your situation.