9 Nifty Bank Index Stocks Investing Strategies

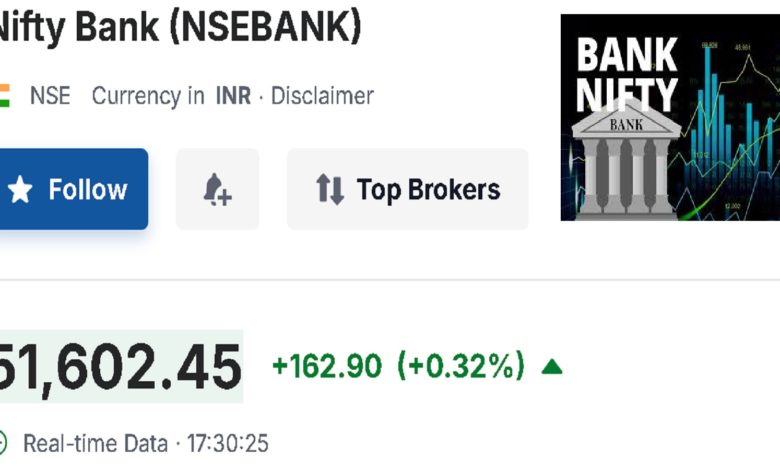

The Nifty Bank Index is a specialized stock market index in India that tracks the performance of the banking sector.

This index is crucial for investors interested in gaining exposure to the banking sector, one of the most dynamic and influential parts of the Indian economy.

The Nifty Bank Index comprises the most liquid and large capitalized Indian banking stocks, making it a reliable indicator of the sector’s performance.

What are Nifty Bank Index Stocks?

Nifty Bank Index stocks are a collection of banking sector stocks that form part of the Nifty Bank Index.

These stocks are carefully selected based on various criteria, including market capitalization, liquidity, and financial performance.

The Nifty Bank Index itself is a subset of the Nifty 50 Index, which tracks the top 50 companies listed on the National Stock Exchange (NSE) of India.

The Nifty Bank Index includes stocks of both public and private sector banks, providing a comprehensive overview of the banking industry.

Nifty Bank Index Stocks List

The Nifty Bank Index comprises 12 stocks as of the latest update.

These stocks include some of the largest and most prominent banks in India, such as HDFC Bank, ICICI Bank, State Bank of India (SBI), Axis Bank, Kotak Mahindra Bank, IndusInd Bank, Bandhan Bank, and others.

These banks are chosen based on their market capitalization, trading frequency, and overall impact on the Indian economy. The index is reviewed periodically to ensure it reflects the current market conditions and includes the best-performing stocks in the banking sector.

Importance of the Nifty Bank Index

The Nifty Bank Index plays a significant role in the Indian stock market for several reasons. Firstly, it represents the banking sector, which is a critical component of the Indian economy.

The performance of the banking sector often reflects the overall economic conditions, making the Nifty Bank Index a valuable indicator for investors.

Secondly, the index provides investors with an opportunity to invest in a diversified portfolio of banking stocks, reducing the risk associated with investing in individual stocks.

Lastly, the Nifty Bank Index is a benchmark for mutual funds and exchange-traded funds (ETFs) that focus on the banking sector, providing a standard for evaluating their performance.

Strategies for Nifty Bank Index Stocks Investing

Investing in Nifty Bank Index stocks requires a well-thought-out strategy. Here are some key strategies that can help investors make informed decisions:

1. Diversification

Diversification is a fundamental strategy in investing. When investing in Nifty Bank Index stocks, it’s essential to diversify your portfolio by including a mix of large-cap, mid-cap, and small-cap bank stocks.

This strategy helps spread risk and ensures that your investment is not overly reliant on the performance of a single stock or segment.

For example, while large-cap stocks like HDFC Bank and ICICI Bank offer stability, mid-cap and small-cap stocks can provide higher growth potential.

2. Long-Term Investment Horizon

Investing in Nifty Bank Index stocks should be viewed as a long-term strategy. The banking sector is subject to various economic cycles, and short-term market volatility can impact stock prices.

But, over the long term, well-managed banks with strong fundamentals tend to perform well and deliver significant returns to investors. Therefore, having a long-term perspective allows investors to ride out short-term fluctuations and benefit from the growth potential of the banking sector.

3. Regular Monitoring and Rebalancing

The Nifty Bank Index is subject to periodic changes, with stocks being added or removed based on their performance and market conditions.

As an investor, it is crucial to regularly monitor the performance of the stocks in your portfolio and rebalance it as needed. This may involve selling underperforming stocks and investing in new entrants to the index.

Rebalancing ensures that your portfolio remains aligned with your investment goals and the evolving market conditions.

4. Fundamental Analysis

Before investing in any Nifty Bank Index stock, it is essential to conduct a thorough fundamental analysis of the bank.

This analysis involves evaluating the bank’s financial statements, including its income statement, balance sheet, and cash flow statement. Key metrics to consider include the bank’s profitability, asset quality, capital adequacy, and growth prospects.

A sound fundamental analysis can help identify banks with strong financial health and growth potential, making them suitable candidates for investment.

5. Keeping an Eye on Economic Indicators

The banking sector is closely tied to the broader economy.

Economic indicators such as interest rates, inflation, gross domestic product (GDP) growth, and credit demand significantly impact the performance of Nifty Bank Index stocks.

Investors should keep an eye on these indicators and understand how they affect the banking sector.

For example, rising interest rates can increase the profitability of banks, while a slowdown in economic growth can lead to higher default rates and impact bank earnings.

Developing a stock strategy for investing in Nifty Bank Index stocks involves a combination of technical analysis, market trends, and an understanding of macroeconomic factors. Here are some essential components of a robust stock strategy for Nifty Bank Index stocks:

6. Technical Analysis

Technical analysis involves studying historical price movements, trading volumes, and other market data to identify patterns and trends.

For Nifty Bank Index stocks, technical analysis can help identify entry and exit points based on support and resistance levels, moving averages, and other technical indicators.

By using technical analysis, investors can make more informed decisions about when to buy or sell stocks within the Nifty Bank Index.

7. Sectoral Trends and Sentiments

Understanding sectoral trends and market sentiment is crucial for developing a stock strategy for Nifty Bank Index stocks.

Investors should stay updated on the latest news and developments in the banking sector, including regulatory changes, policy decisions, and technological advancements.

Positive news and favorable policy decisions can boost investor sentiment and drive stock prices higher, while negative news can have the opposite effect. Keeping an eye on these trends can help investors make timely and informed decisions.

8. Risk Management

Risk management is a critical aspect of any investment strategy, including investing in Nifty Bank Index stocks. Investors should set stop-loss levels to limit potential losses and protect their investments from significant downturns.

Also, diversifying across different banking stocks and sectors can help mitigate risk. It is also advisable to avoid overexposure to a single stock or sector to reduce the impact of any adverse market movements.

9. Leveraging Exchange-Traded Funds (ETFs)

For investors who prefer a more hands-off approach, investing in exchange-traded funds (ETFs) that track the Nifty Bank Index can be an effective strategy.

ETFs provide exposure to a diversified portfolio of banking stocks, reducing the need for individual stock selection and analysis.

ETFs offer liquidity, transparency, and lower management fees compared to actively managed funds, making them an attractive option for many investors.

Conclusion

The Nifty Bank Index provides a comprehensive view of the Indian banking sector, encompassing a diverse range of public and private sector banks.

Investing in Nifty Bank Index stocks offers investors exposure to one of the most critical sectors of the Indian economy.

By following sound investing strategies such as diversification, long-term investment, regular monitoring, and fundamental analysis, investors can maximize their returns while managing risks.

Developing a robust stock strategy that includes technical analysis, understanding sectoral trends, and effective risk management can further enhance investment outcomes.

Whether you are a seasoned investor or a beginner, the Nifty Bank Index offers a valuable opportunity to participate in the growth of India’s banking sector.