AREIT: A Stable Investment in the Growing Philippine Real Estate Market

In recent years, the real estate sector in the Philippines has witnessed significant growth, driven by rapid urbanization, a robust economy, and increasing demand for commercial and residential properties. Amid this backdrop, AREIT, the first real estate investment trust (REIT) in the Philippines, has emerged as a promising investment opportunity. With its steady performance, solid financials, and strategic market positioning, AREIT offers a compelling case for investors looking to tap into the growing Philippine real estate market.

Understanding AREIT: A Pioneering REIT in the Philippines

AREIT, Inc. is a real estate investment trust listed on the Philippine Stock Exchange (PSE). As the first REIT in the country, AREIT has paved the way for other companies to follow suit, contributing to the growth of the REIT market in the Philippines. The company’s portfolio consists of high-quality commercial properties, including office buildings and mixed-use developments located in prime business districts.

AREIT’s business model is centered on acquiring, managing, and developing income-generating real estate assets. The company generates revenue primarily from leasing its properties to high-quality tenants, including multinational corporations and local enterprises. As a REIT, AREIT is required by law to distribute at least 90% of its distributable income to shareholders in the form of dividends, making it an attractive option for income-focused investors.

Stock Performance and Market Dynamics

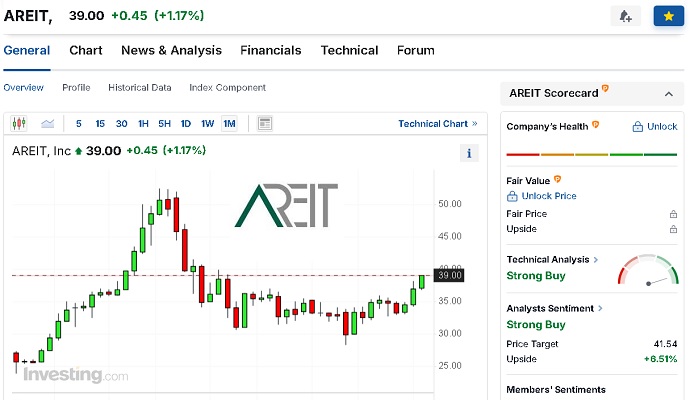

AREIT’s stock has shown resilience and steady growth since its listing. Currently trading at a bid/ask price of ₱42.40/₱39.00, the stock closed at ₱39.00 in its previous trading session, with an opening price of ₱38.50. The stock’s daily trading range of ₱38.45 to ₱39.00 reflects its stability, while its 52-week range of ₱28.20 to ₱39.00 indicates a consistent upward trend.

Over the past year, AREIT’s stock has appreciated by 13.57%, outpacing many other investments in the real estate sector. This growth is a testament to the company’s strong fundamentals and investor confidence in its future prospects. With a market capitalization of ₱92.38 billion and 2.37 billion shares outstanding, AREIT is a major player in the Philippine REIT market.

Strong Financial Performance

AREIT’s financial performance underscores its potential as a solid investment. The company reported revenue of ₱7.78 billion and a net income of ₱5.46 billion, resulting in an earnings per share (EPS) of 2.63. With a price-to-earnings (P/E) ratio of 8.27, the stock is relatively undervalued compared to its peers, offering a potentially attractive entry point for investors.

One of AREIT’s key strengths is its ability to generate consistent returns. The company’s return on assets (ROA) is 6.7%, indicating efficient management of its asset base to generate profits. Similarly, its return on equity (ROE) of 7.6% reflects the company’s effectiveness in utilizing shareholder equity to generate earnings. These metrics highlight AREIT’s strong operational efficiency and its ability to deliver value to its investors.

AREIT’s profitability is further underscored by its gross profit margin of 72.4%, which demonstrates the company’s ability to maintain high profitability while controlling costs. This strong margin is particularly impressive given the competitive nature of the real estate market in the Philippines, where managing operational costs and maximizing rental income are crucial to maintaining profitability.

Investment Potential and Growth Prospects

The investment potential of AREIT lies not only in its strong financial performance but also in its strategic market positioning and growth prospects. As a pioneer in the Philippine REIT market, AREIT has established itself as a reliable and stable investment option for those looking to gain exposure to the real estate sector.

One of the key factors driving AREIT’s growth is the increasing demand for commercial and residential properties in the Philippines. The country’s robust economic growth, coupled with rapid urbanization and a young, growing population, has led to a surge in demand for office spaces, retail properties, and residential developments. AREIT’s portfolio of high-quality, income-generating properties positions it well to capitalize on this trend.

The company’s strategic focus on acquiring and developing properties in prime business districts ensures that its portfolio remains attractive to tenants. AREIT’s properties are located in key business hubs such as Makati, Bonifacio Global City, and Cebu, where demand for office spaces and commercial properties remains strong. This geographic concentration in high-demand areas provides AREIT with a competitive edge, enabling it to maintain high occupancy rates and generate stable rental income.

Dividend Potential

One of the most attractive aspects of investing in AREIT is its dividend potential. As a REIT, AREIT is required to distribute at least 90% of its distributable income to shareholders as dividends. This regulatory requirement ensures that investors receive a steady stream of income from their investment in AREIT.

Given the company’s strong financial performance and stable cash flow, AREIT is well-positioned to continue delivering attractive dividends to its shareholders. For income-focused investors, this makes AREIT a compelling investment option, offering both capital appreciation and regular income.

Risks and Considerations

While AREIT presents a compelling investment opportunity, it is important for investors to consider potential risks. One of the primary risks associated with investing in REITs is market volatility, which can impact the value of the underlying properties and, by extension, the stock price. Additionally, changes in interest rates can affect the attractiveness of REITs, as higher interest rates may lead to increased borrowing costs and reduced profitability.

The real estate market is subject to cyclical trends, and economic downturns can lead to decreased demand for commercial and residential properties. This, in turn, could impact AREIT’s rental income and occupancy rates, potentially affecting its financial performance and dividend payouts.

However, AREIT’s strong market positioning, high-quality property portfolio, and prudent management practices mitigate some of these risks. The company’s focus on prime locations and high-quality tenants helps to ensure a steady stream of rental income, even in challenging economic conditions.

Conclusion

AREIT stands out as a stable and attractive investment option in the growing Philippine real estate market. With its strong financial performance, strategic market positioning, and potential for capital appreciation and dividend income, AREIT offers investors a unique opportunity to benefit from the country’s real estate growth. While there are risks associated with investing in REITs, AREIT’s solid fundamentals and growth prospects make it a compelling choice for long-term investors looking to diversify their portfolio and gain exposure to the real estate sector.

As the first Philippine REIT, AREIT has set a high standard for other companies to follow, and its continued success will likely pave the way for further growth in the REIT market. For investors seeking a reliable and stable investment in the Philippine real estate sector, AREIT is a name worth considering.