Life Insurance Over 50

The importance of life insurance for individuals over 50 in our comprehensive guide. Learn about benefits, types of coverage, and key considerations to secure your family’s financial future. Make an informed decision for lasting peace of mind. Life is a journey filled with milestones, challenges, and unexpected turns. As we grow old, our priorities in life suddenly change, and one of the most important aspects that deserve our precious attention is securing the financial future of our family and loved ones. This is where life insurance steps in, providing a safety net that offers peace of mind and protection (financial protection).

In this blog post of InvestmentTotal.com, we will discuss the importance of life insurance for individuals over 50, the benefits of life insurance for 50 years old people, available options, and things to consider when buying life insurance over 50.

See Also: Reasons Why You Should Buy Life Insurance Right Now!

Life insurance is a basic component of financial planning, and once people reached the age of 50 and beyond, its significance becomes even more pronounced. At this stage of life, many people have dependents, mortgages, and other financial responsibilities. Having a comprehensive life insurance policy ensures that our family and loved ones are safeguarded in the event of the unexpected.

Benefits of Life Insurance for Those Over 50

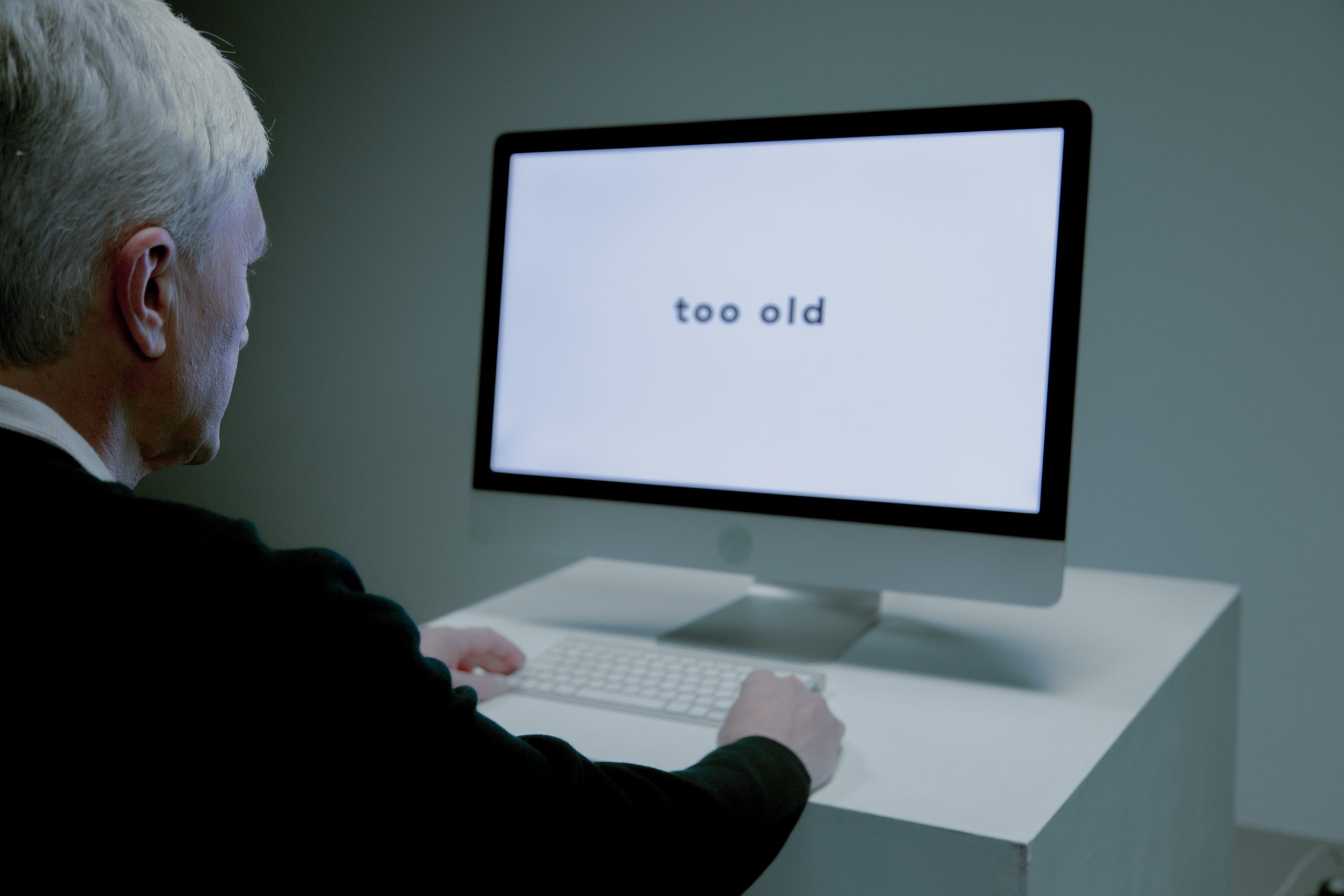

Photo by Ron Lach via Pexels CC 2.0Financial Security for Dependents

If you are an individual age over 50 that have dependents who rely on your income or financial support, life insurance provides a safety net that replaces lost income, covers outstanding debts, and ensures that your loved ones can maintain their quality of life.

Read More: Financial Planning for Retirement

Estate Planning

Life insurance can be a valuable tool for estate planning for people over 50 because at this age they have acquired real estate assets. Life insurance over 50 will help cover estate taxes, ensuring that your heirs receive their inheritance without the burden of hefty tax liabilities.

You have to have a strategic estate planning if you are over 50. Estate planning gains paramount importance for those over 50 as it transcends mere asset distribution, focusing on securing your loved ones’ future and preserving your hard-earned legacy.

Photo by SHVETS production via PexelsThis stage of life prompts essential steps like updating your will, creating trusts, designating beneficiaries, and planning for long-term care. Navigating tax implications through gifting, optimized retirement account strategies, and considering charitable giving becomes crucial.

Transparent family communication, careful selection of executors/trustees, and periodic plan reviews ensure that your intentions are met. By embracing estate planning as a vital task, you assure yourself and your family of peace of mind, knowing that your wishes will be honored and your legacy perpetuated.

Paying Off Debts

Many people age over 50 has outstanding debts, such as mortgages and loans, can be a considerable burden on your family and loved ones if you were to pass away unexpectedly. Life insurance can help cover these debts, preventing financial strain on your family.

Funeral and End-of-Life Expenses

People age over 50 should have life insurance. Funeral and end-of-life expenses can be substantial. Life insurance can alleviate this financial burden, allowing your family to focus on grieving and healing without worrying about costs.

Types of Life Insurance for Individuals Over 50

Term Life Insurance

This type of insurance provides coverage for a specific term, typically 10, 20, or 30 years. This is why an individual should buy life insurance at a young age and not just wait when he is at 50 years old. It’s often more affordable than permanent life insurance but doesn’t accumulate cash value.

Whole Life Insurance

Imagine if you bought life insurance at age 25, and you’ll waited until you’re over 50 years old. Whole life insurance offers lifelong coverage and includes a cash value component that grows over time. It’s a more expensive option but provides both protection and a savings element.

Universal Life Insurance

Universal life insurance offers flexibility in premium payments and death benefits. It also accumulates a cash value that can be used for various purposes.

Final Expense Insurance

This type of insurance is designed to cover end-of-life expenses (very important for people age over 50), such as funeral costs and medical bills. It’s typically easier to qualify for and has lower coverage amounts.

Considerations When Choosing Life Insurance for Individuals Over 50

Pexels.com PhotoCoverage Amount

For people age over 50 calculate the coverage amount based on your financial responsibilities, including debts, living expenses, and future needs of your dependents.

Premium Affordability

Consider your budget when choosing a policy if you are buying life insurance over 50. While permanent life insurance offers lifelong coverage and savings, term life insurance might be more affordable.

Health Condition

Some policies may require a medical examination. However, there are options like no-medical-exam life insurance, which could be suitable if you have health concerns.

As individuals surpass the age of 50, their health conditions can grow more intricate and diverse. Common concerns encompass chronic ailments like hypertension, diabetes, and arthritis, while heart health becomes paramount due to heightened risks of conditions such as coronary artery disease.

Bone health also warrants attention with the onset of osteoporosis, potentially leading to increased susceptibility to fractures.

Cognitive health poses a significant worry as conditions like Alzheimer’s disease can impede memory and thinking abilities.

Age-related vision and hearing changes, metabolic shifts affecting weight management, and an elevated likelihood of cancer further contribute to the health landscape.

While these issues prevail, embracing a wholesome lifestyle inclusive of a balanced diet, regular exercise, and medical screenings can substantially enhance overall well-being for those over 50.

Policy Riders

Explore policy riders that can enhance your coverage, such as accelerated death benefits, which allow you to access a portion of the death benefit if you’re diagnosed with a terminal illness.

Conclusion

Life insurance over 50 is a crucial component of your financial plan that ensures your loved ones are protected and financially secure. By carefully considering your needs, options, and the type of policy that aligns with your goals, you can make a well-informed decision that provides peace of mind and lasting security for you and your family. Life insurance is not just about planning for the end—it’s about securing a brighter and more stable future.