Net Asset: Meaning, Example Calculation, Formula

What is Net Asset?

Net asset represents the total value of a company’s or individual’s assets minus their liabilities. It’s a measure that shows what remains if all liabilities are paid off. For businesses, this figure can give insight into the overall financial health and the ability to grow or withstand financial challenges. The formula to calculate net asset is simple:

Net Asset Formula:

Net Asset=Total Assets−Total Liabilities

Let’s break this down. Total assets are everything owned by a company or individual that has value. This could include cash, real estate, stocks, and other investments. On the other hand, liabilities are the debts or obligations, such as loans, mortgages, or unpaid bills. By subtracting liabilities from assets, you get the net asset value.

Key Takeaways:

- Net asset provides a clear picture of financial health.

- It’s calculated by subtracting liabilities from assets.

- A positive net asset shows financial strength, while a negative value indicates more debts than assets.

- This metric is crucial for investors, businesses, and individuals for making decisions.

The Importance of Net Asset in Business

In the business world, net assets are essential for understanding a company’s worth. Investors look at net asset value (NAV) to decide whether to invest in a company. A strong net asset means the company is likely managing its finances well, has valuable assets, and fewer liabilities.

For example, a company with $10 million in assets and $3 million in liabilities would have a net asset of $7 million:

Net Asset=$10,000,000−$3,000,000=$7,000,000

This number reflects the company’s value after all debts are paid. It tells potential investors or creditors how much the business is worth in its simplest form.

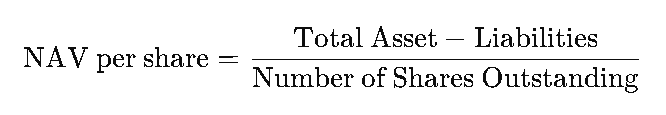

Net Asset Value (NAV) in Investments

The term net asset is also used in the investment world, particularly with mutual funds and exchange-traded funds (ETFs). The net asset value (NAV) refers to the total value of the assets in a fund, minus its liabilities, divided by the number of outstanding shares.

This figure helps investors know how much each share in the fund is worth. A higher NAV means the fund holds valuable assets, which can attract more investors.

Modified Accelerated Cost Recovery System (MACRS)

When calculating net assets for businesses, companies may use the Modified Accelerated Cost Recovery System (MACRS) to depreciate their assets. This system allows companies to recover the cost of tangible assets like equipment or machinery over time. MACRS helps businesses lower their taxable income by allowing for faster depreciation in the early years of an asset’s life.

For example, a business buys equipment for $100,000. Under MACRS, they can deduct a larger portion of the asset’s value in the first few years, which reduces their taxable income and improves their net assets in the short term. Here’s a sample calculation under the MACRS method:

Year 1 Depreciation: $20,000

Year 2 Depreciation: $32,000

Year 3 Depreciation: $19,200

Using MACRS helps businesses manage cash flow better by lowering their tax obligations in the initial years of purchasing new assets.

Net Asset vs. Equity

Net asset and equity are closely related terms. While net asset refers to the difference between total assets and liabilities, equity represents ownership in a company. In a corporation, equity is known as shareholders’ equity.

For example, if a company has $5 million in assets and $2 million in liabilities, the remaining $3 million is both the net asset and the shareholders’ equity.

Equity=Net Asset=Total Asset−Liabilities

This equation shows that the value remaining after debts are paid is what shareholders own in the business. For investors, a higher equity or net asset figure can signal a company’s stability.

Impact of Liabilities on Net Asset

Liabilities play a big role in calculating net assets. High liabilities can reduce net asset value, even if a company has many assets. For example, a business may own $500,000 in real estate, but if it has $450,000 in mortgages and loans, the net asset is only $50,000:

Net Asset=$500,000−$450,000=$50,000

In this case, the large debt reduces the overall value, signaling that the business might be in a weaker financial position. Companies with low liabilities and high assets generally have stronger net asset values.

Growing Net Assets Over Time

Increasing net assets can be a sign of business growth. Companies can grow their net assets by:

- Reducing liabilities, like paying off debt.

- Increasing assets, like acquiring valuable real estate or generating higher profits.

- Managing expenses effectively to keep liabilities low.

An upward trend in net asset value signals financial stability and can attract investors or creditors looking for reliable businesses.

Modified Accelerated Cost Recovery System MACRS and Net Assets

Using the Modified Accelerated Cost Recovery System (MACRS) can also influence a company’s net asset value. By depreciating assets faster in the early years, companies reduce the book value of their assets, which lowers the total asset figure. However, this can be advantageous for tax purposes, as mentioned earlier.

For instance, a business buys a machine for $50,000. Under MACRS, the company might depreciate $15,000 in the first year. This reduces the asset value on the books but allows the business to save on taxes:

- Year 1: $15,000 depreciation

- Year 2: $12,000 depreciation

- Year 3: $10,000 depreciation

This accelerated depreciation reduces the company’s total asset figure but can improve cash flow and help the company reduce its liabilities faster.

Example of Calculating Net Asset

Let’s take a real-world example. A business has the following on its balance sheet:

- Cash: $20,000

- Real Estate: $150,000

- Equipment: $30,000

- Total Liabilities: $60,000

Using the net asset formula, you would calculate:

Net Asset=(20,000+150,000+30,000)−60,000=200,000−60,000=140,000

This company’s net asset is $140,000, showing that after paying off its debts, the business still holds significant value.