How to Open a COL Financial Account in the Philippines?

Here is the guide on how to open COL Financial account in the Philippines as your stock brokerage company. This is your opportunity to invest in the Philippine Stock Market. Opening an account in COL Financial as your chosen stock broker is very easy. Read the COL Financial review before you proceed in this guide.

You must do the following to save a lot of time and get easily approve in applying a COL Financial account. This article is one of our guides about COL Financial Philippines.

See Also: COL Financial Easy Investment Program for Stock Market Investors

Things to Do:

- Attend COL Financial seminar for you to acquire more knowledge about investing in the Philippine Stock Market.

- Download application form

- Prepare necessary documents and money

Things to Prepare if You Want to Open a COL Financial Account

- Valid ID’s

- Application form (download at official website)

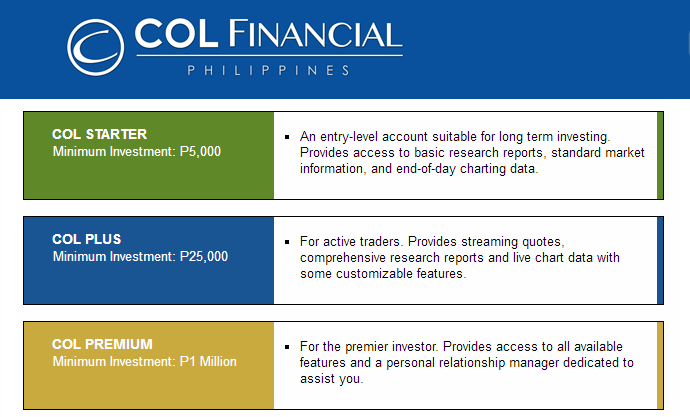

- Investment Capital (Minimum of P5,000)

How to Open a COL Financial Account in the Philippines?

- Choose your account type

- Fill out COL Financial application forms

- Prepare additional requirements

- Submit forms and requirements

- Fund your COL Financial Account

Step 2. Fill Out COL Financial Application Forms

After you have downloaded the form and filled out, print the form and do not forget to sign in the signature fields.

Must download: Customer Account Information Form (CAIF), Online Securities Trading Agreement (OSTA) and 2 specimen signature cards that all can be found in www.COLFinancial.com

Step 3. Prepare Additional Requirements

If you are planning to open a COL Financial joint account (ITF) “in-trust account for” account for your kids (minor applicant). The required documents are valid ID of parents, birth certificate of a child, ITF supplementary agreement with signature and billing statement.

Important: Billing statement must be recent, no later than 3 months past.

Step 4. Submit Forms and Requirements

Double check your spellings in your forms, make sure it has signatures. Prepare all necessary documents required by COL Financial. After step number 3, then this is the time you have to submit your forms and documents at COL Financial office to review your application.

Tips: Use envelope and at the front upper part write your name, address and phone numer. At the center of the large envelope write the COL Financial company name and address:

COL Business Center

2403-B East Tower, PSE Centre

Exchange Road, Ortigas Center,

Pasig City, Philippines 1605

You can submit the documents via LBC (in my own experience) and after few days you will receive a confirmation number via email that indicates your COL account number and your application status.

Step 5. Fund Your COL Financial Account

Assuming you have receive the confirmation email about your application status, this is now the time you have to fund your COL Financial account to start buying stocks. There are easy ways on how to fund your COL Financial account, it can be done via online banking, over the counter, or go personally in COL business center.

Related:Fund COL Financial Account: BDO Online Banking

For you to save time, you can use online bills payment. But since you are not familiar with online banking, let us talk about funding your COL Financial account via BDO over the counter. Even weekends BDO bank branch are open (in the mall).

A. Go to any BDO branch and get payment slip (color orange)

B. Write in the company name: COL Financial Group Inc.

C. Filled out the date

D. At the subscribe account number, write your COL Financial account number (example: 0123-0321) (Your account number received via eMail in step 4)

E. Write your complete name at subscriber’s name

F. Fill out the denominations, or total payments.

Wait for few hours if weekdays and 2 days if weekends after you fund your COL Financial account, you will receive a confirmation about your payments plus your password.

Now go to www.COLFinancial.com and log in. I will discuss in my next topic on how to buy stocks using your COL Financial account.

Learn Stock Investing at COL Financial Seminars

Warning: Investing in the stock market involves risk. You must be careful on what stocks to buy, when to buy or when to sell it. COL Financial can help you to succeed in investing, attending their FREE seminars can help you succeed in investing in the Philippine Stock Market. Attend seminars and ask everything you want to know.

It is your hard earned money. Don’t lose it, the rule in investing is “never lose money” as popularized by Mr. Warren Buffett as one of the most richest and most successful investors in the world. Gain knowledge before gain profits, that’s my advice.

You will never realize the value of 1 cent until its gone. Be a wise and smart investor. Have time to attend seminars, schedules of seminars are also announce at COL Financial official website.

Disclaimer:I am not affiliated with COL Financial Group, Inc. I just want to share my experience and knowledge. All logos, registered trademarks or slogans mentioned in this blog are owned by their respective companies.

Other useful guides can be found at COL Financial Philippines

What’s Next? – Share Financial Education

Please subscribe to InvestmentTotal.com, like my blog Facebook page, follow it on twitter to receive daily/weekly updates about investing and personal finance. Happy investing, I will be glad to to know someday you will become a multi-millionaire. Share this topic to your friends and let them invest in the Philippine Stock Market via COL Financial, too.

Now you know how to open a COL Financial account in the Philippines. Open one and start buying and selling stocks. Have a successful investing journey in the Philippine Stock Market. May our dear God bless you prosperity, happiness and success.