Tax

-

Capital Gains: Definition, Types, Calculation, Minimize Tax

What is Capital Gains? Capital gains refer to the profit made from selling an asset for more than what was…

-

Tax Relief: Meaning, Types, Examples, & Qualifications

Tax relief is a way to reduce the total amount of tax you owe to the government. This can come…

-

File Taxes Online

Wondering how to file taxes online? Filing taxes online means submitting your tax returns using digital platforms, rather than dealing…

-

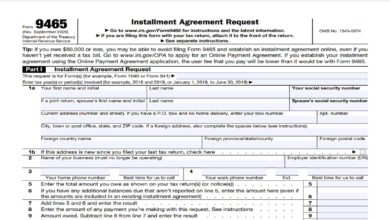

IRS Installment Plan: How to Pay Taxes in Monthly Payments

What is the IRS Installment Plan? The IRS installment plan is a method that allows taxpayers to pay off their…

-

Tax Planning: Meaning, Strategies, & Example

What is Tax Planning? Tax planning is the process of analyzing your financial situation to ensure you pay the least…

-

Form 1040-A: Simplified Tax Filing

What is Form 1040-A? Form 1040-A was a simplified version of the IRS tax form used by individuals to file…

-

1040 U.S. Individual Tax Return Form

The 1040 U.S. Individual Tax Return Form is one of the most important documents for American taxpayers. This form helps…

-

A-B Trust: Definition, How It Works, and Tax Benefits

When it comes to managing wealth and ensuring it passes on smoothly to future generations, an A-B Trust can be…

-

The Significance of Coupons and Promo Codes in Tax Software Selection

Regarding tax software, function, ease of use, and accuracy are non-negotiable features. A poorly functioning or inaccurate program can damage…