3 Powerful Reasons Why General Motors Stock Surprised Investors with Impressive Earnings

General Motors Stock Update: Earnings and Revenue Beat Expectations

General Motors stocks can surprise investors with this strong financial data and information. General Motors (GM) recently reported strong financial results, surprising the market with better-than-expected earnings and revenue.

General Motors Company generated $171.84 billion in revenue last year, with the majority—$141.44 billion—coming from its top-performing division, GM North America.

This division saw significant growth, up from $128.38 billion the previous year. The United States was the largest contributor to GM’s revenue, accounting for $139.60 billion last year, compared to $127.83 billion the year before.

The company’s earnings per share (EPS) for the last quarter came in at $3.06, significantly higher than the estimated $2.70, marking a 13.17% surprise. Revenue also exceeded expectations, reaching $47.97 billion, surpassing the forecasted $45.41 billion.

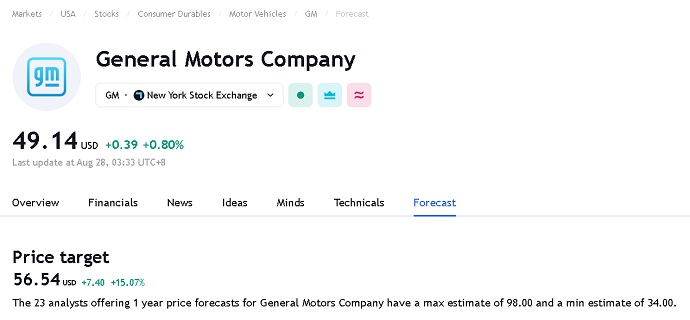

GM’s market capitalization stands at $55.32 billion, with a dividend yield of 0.92%. The company has a price-to-earnings ratio (P/E) of 5.46 and a basic EPS of $8.95 for the trailing twelve months (TTM).

Looking ahead, GM is expected to report its Q3 2024 earnings on October 22, 2024. Analysts predict an EPS of $2.35 and revenue of $44.45 billion for the upcoming quarter.

Investors should also note the upcoming ex-dividend date on September 6, 2024, with a dividend payment of $0.12 per share scheduled for September 19, 2024. GM’s current dividend yield on a TTM basis is 0.86%.

CEO Mary Barra continues to steer the company through a challenging automotive market, maintaining strong financial performance despite global economic uncertainties.

Is General Motors stock undervalued?

Based on the available data, there are several indicators that suggest General Motors (GM) stock might be undervalued:

Low Price-to-Earnings (P/E) Ratio

GM has a P/E ratio of 5.46, which is significantly lower than the average P/E ratio of the broader market and many of its peers in the automotive industry. A low P/E ratio often indicates that a stock is undervalued compared to its earnings potential.

Strong Earnings Performance

GM recently posted an EPS of $3.06 for the last quarter, beating estimates by 13.17%. This strong performance indicates that the company is generating solid profits, which is not fully reflected in its current stock price.

Robust Revenue Growth

GM’s revenue for the last quarter was $47.97 billion, also surpassing expectations. Consistent revenue growth paired with a low stock price can signal undervaluation.

Market Capitalization vs. Fundamentals

With a market cap of $55.32 billion and strong fundamentals (including a basic EPS of $8.95 TTM), the company’s valuation seems modest, suggesting the stock might be undervalued.

Dividend Yield

GM offers a dividend yield of 0.92%, which, while not exceptionally high, provides some income for investors. A stable dividend from a company with solid earnings is another sign that the stock may be undervalued.

3 Reasons General Motors Stock Surprised Investors with Strong Earnings

Better-Than-Expected Earnings Per Share (EPS)

General Motors (GM) reported an EPS of $3.06 for the last quarter, significantly surpassing the analysts’ estimate of $2.70.

This 13.17% surprise indicates that GM’s profitability is stronger than anticipated, driven by robust sales and effective cost management. The company’s ability to outperform expectations demonstrates its resilience in a challenging market environment.

Higher-Than-Projected Revenue

GM’s revenue for the same period reached $47.97 billion, exceeding the forecasted $45.41 billion.

This higher-than-expected revenue showcases GM’s strong market presence and effective strategies in both traditional and electric vehicle segments.

The company’s ability to drive sales growth even in a competitive market is a key reason why investors were taken by surprise.

Strategic Cost Management and Operational Efficiency

Another factor contributing to GM’s strong earnings is its focus on cost management and operational efficiency. Despite global supply chain challenges and economic uncertainties, GM managed to maintain healthy profit margins.

This disciplined approach to managing costs without sacrificing quality or market share played a significant role in boosting the company’s bottom line, leading to a positive earnings surprise.

These factors highlight why General Motors stock performed better than expected, reinforcing the company’s position as a strong player in the automotive industry.

GENERAL MOTORS STOCKSOURCE:

GM Stock Might Be Undervalued

While the above indicators suggest that GM stock might be undervalued, it’s essential to consider broader market conditions, industry trends, and potential risks, such as economic downturns, supply chain disruptions, and shifts in consumer demand toward electric vehicles.

Investors should conduct further research or consult with a financial advisor before making investment decisions.