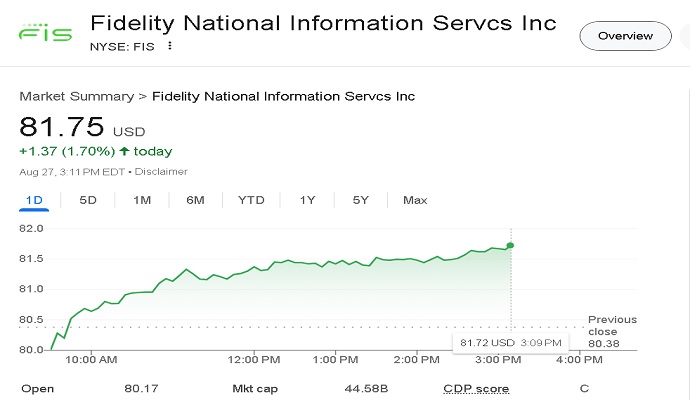

FIS Stock News: Strong Performance in Q2 2024 Despite Cash Decline

In June 2024, Fidelity National Information Services (FIS) demonstrated a positive performance across key financial metrics. Revenue reached $2.49 billion, up 2.68% year-over-year (Y/Y).

Net income surged to $243 million, marking a staggering 103.68% increase Y/Y. Diluted earnings per share (EPS) also saw impressive growth, climbing by 103.95% to $0.44, while the net profit margin improved to 9.76%, up 103.59% Y/Y.

Impressive Growth Amid Challenges

FIS reported an EPS beat of 10.37% for June 2024, showcasing the company’s ability to surpass earnings expectations. This follows a strong performance in March 2024, where FIS beat EPS estimates by 14.97%.

However, the company faced a setback in December 2023, missing EPS estimates by -13.82%. In September 2023, FIS delivered another positive surprise with a 4.21% EPS beat. Despite these fluctuations, the overall trend in 2024 has been positive for FIS stock.

Operational Strength and Liquidity Concerns

Operationally, FIS saw its operating income increase by 21.9% to $551 million. However, the company experienced a sharp decline in cash, with a net change of -$1.17 billion, a massive drop of 6273.68%.

This reflects significant cash outflows, highlighting potential liquidity concerns moving forward.

Revenue and Cost Efficiency

Revenue grew 2.68% Y/Y, while the cost of revenue increased by 1.25% Y/Y, reaching $1.54 billion. FIS has managed to balance revenue expansion with cost efficiency, maintaining profitability even as expenses rise.

The Q2 2024 data for FIS stock highlights strong financial performance, including revenue growth, net income improvements, and several EPS beats. However, the significant drop in cash is something investors should monitor closely, as it may indicate liquidity challenges in the coming quarters.