It’s true, retirement planning made easy! Just keep on visiting RetirementPlanningIq.com! Yes, finally my retirement had come. Oh I wish, I am so young, there are many years to waited before I get there. I am not in a hurry because I want to enjoy every years that are passing in my life.

Good thing is that retirement planning favors the early birds. What I means is, when you plan your retirement early, you will easily achieve your goal and all your plans will going to happen compare to “rush hour”. As I am always saying to readers of RetirementPlanningIQ.com, the moment you received your first paycheck is the moment you should start planning for your retirement.

I mean is we have to save and invest for retirement. Is that great, of course. It’s just like waiting for a great moment in our entire life. Well, it’s up to you when you want to retire. But my goal is to retire young, at least when I hit the age of 50.

Retirement Planning Made Easy

It is easy to plan for your retirement, s long as you are serious about your retirement. Retirement Planning IQ has several articles that can guide you to find the right and appropriate answer to all retirement planning questions like;

- What to do do during retirement years?

- When is the best time to retire, 50, 65, 50, or at the age of 40?

- Where to spend my retirement years? Overseas, in my own country, in my favorite place?

- Who is the bets person that can help me plan my retirement?

- Why should I retire rich?

- How do I know the enough money to save for my retirement?

- etc..

Steps to Create a Retirement Plan

I will share to you the step by step in my next articles. All I want to share to day is a brief guide about retirement planning.

- Talk to certified financial planner

- Allocate your assets

- Decide where to retire

- Know how much money to save for retirement

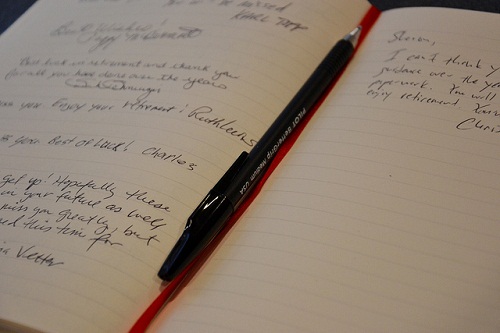

- Write your goals and plans in your diary

Those are some of the basic questions when preparing for a retirement. Let this blog Retirement Planning IQ can help you plan your retirement. Wait for RPIQ updates and series of articles about retirement planning. For the meantime, subscribe to this blog newsletter, just enter your email address in the subscription box. Don’t worry it’s FREE. Thank you!

DISCLAIMER: The information provided on InvestmentTotal.com is for general informational purposes only. The content on this website is not intended to be, and should not be construed as, professional financial advice.