Here’s another useful retirement calculator you can use today as a tool to calculate the exact amount of money you need to retire. Use this retirement calculator. It is a useful tool to help you create a retirement plan.

Using retirement calculator will help us determine the money required to save each month until we get our target retirement savings at the right age. I know you are using other calculators to compute your retirement savings, today, let us use Bloomberg calculator online.

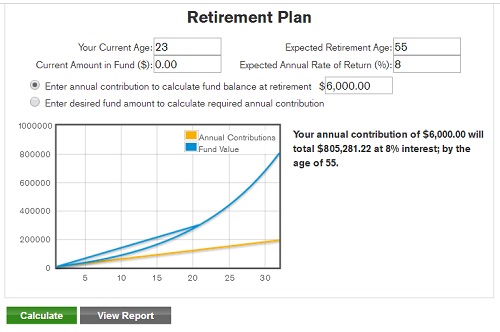

You can view your retirement savings balance. All you need to do if you want to use Bloomberg retirement calculator online is specify your current age, your expected retirement age, your current amount in funds, expected annual rate of return and enter your desired fund amount to calculate required annual contribution.

Retirement Calculator from Bloomberg

Using retirement calculator will help us determine the money required to save each month until we get our target retirement savings at the right age. I know you are using other calculators to compute your retirement savings, today, let us use Bloomberg calculator online.

How to Use Bloomberg Retirement Calculator?

Visit this page and fill out the forms (see screenshot in the image). In example above, I typed 23 as my current age and I want to retire at 55. I use 8% as my expected annual rate of return for my retirement savings and investments and I typed “zero” as my current amount in fund.

Your annual contribution of $6,000.00 will total $805,281.22 at 8% interest; by the age of 55.

- Current Fund Amount: $0.00

- Total Fund Amount: $805,281.22

- Interest: 8 Percent

- Annual Contribution: $6,000.00

- Age to Reach My Goal: Age 55

During my first year, I only have $6,000 retirement savings. After two years, I will have $12, 480 with the interest earned. After 15 years of consistent saving $6,000 per year, my money grows to $162,912.68 with a total amount of $90,000 as my contribution. After 32 years, I have a total contribution for only $192,000 but the total fund value is $805,281.22.

I believe in the power of compound interest. That’s the reason why late retirement planning is not recommended. If you want to retire early, save money early. As simple as that. Also, making use of retirement calculators can help you find out how much money is required to save every month.

Retirement Quote of the Day:

Money you won’t need to use for at least seven years is money for investing. The goal here is to have your account grow over time to help you finance a distant goal, such as building a retirement fund. Since your goal is in the future, money for investing belongs in stocks. — Suze Orman

What about you? Which retirement calculator are you using right now? Did you used the calculator from Bloomberg? Stay tuned to Retirement Planning IQ for more retirement calculators online. Share your comment below and do not forget to tell this page to your friends.

DISCLAIMER: The information provided on InvestmentTotal.com is for general informational purposes only. The content on this website is not intended to be, and should not be construed as, professional financial advice.