Investing in bonds can be done via mutual funds and trust accounts in the bank. Bonds are low risk types of investments. Bond should be included in your investment portfolio if you want to diversify your assets. A reader asked; “how to invest in US bonds when interest rates rise in the future?” Before we will continue this discussions, let us first know “what is a bond investment all about” and “how investing in bonds works”. Bonds are issued by government or private corporations to raise funds for their business operations.

The private companies or the government and the investor have an agreement for specific return on investment or specific rates when the time bonds mature. There will be a specific maturity date when investing in bonds.

How Does Bonds Works?

It is the process of raising funds for a business to expand its business. Say for example, ABCDEF company is selling softdrinks. The company become popular and has plan to deliver their products worldwide. ABCDEF company will need funds for its expansion.

Now, ABCDEF company will issue a bonds to public worth $100,000,000 that earns 5% per year within 10 years. Assume the bondholders are 30,000. Each of them will get paid after 10 years depending on how many units they purchased.

How to Invest in US Bonds

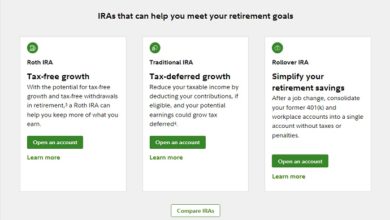

There are many ways to invest in bonds especially if you are in residing in United States. You can start investing in bonds through mutual funds bond type, ETFs or via trust accounts.

How investors make money in investing in bonds? The investor will earn interest each year but the earned interest will only received by the investor after the maturity date. Say for example, if the par value is $100. Investor can buy bonds in any multiple of $100, $200, $300, etc. The issuer (in our example ABCDEF company) will receive the sales proceeds and use the proceeds in their business operations.

Hint: Original investment and the earned interest will received by the investor (bondholder) on the maturity date. When calculating the return in bonds, all you need to do is to know the specific interest of a issued bond. If for example, the ABCDEF company issued a bond that earns 8% in 5 years. If you have $10,000 worth of investment, your investment should earn $800 after 5 years. Therefore, the investor will receive a total amount of $10,800 after 5 years.

Have tried to invest in bonds? Which one do you prefer? Government bonds or corporate bonds? Any questions regarding investing in bonds? Kindly share your opinion in the comment box below.

DISCLAIMER: The information provided on InvestmentTotal.com is for general informational purposes only. The content on this website is not intended to be, and should not be construed as, professional financial advice.