Here is the step by step guide on how to start investing money in the stock market. A easy to follow investing guide for beginners.

How to start investing in stocks is the most common question of beginners who just heard about stock investing. Learning stock market trading and investing is fun! Besides, it can help you achieve financial freedom! InvestmentTotal always receive similar questions, how to buy stock shares, what are the best stocks to buy, etc. Let us now answer these questions in a concise manner.

To be more specific and to avoid investing mistakes, the guide on investing are as follows. Before you start investing in stocks, you must consider the following things.

A. Attend Investing Seminars

First, do you attended stock investing seminars or you just heard about it, you just have read some books, magazines, blogs or in an online forum? Or some of your friends in social media send you a message about investment opportunity. It is important that you attend seminars or study stock technical analysis for you to know more and become expert in stock investing.

B. Ask a Certified Financial Planner

Second, have you consulted with a certified financial planner? It is easy to start investing in any of the investment vehicle aside from stocks. But, you must be guided by a certified financial adviser to avoid financial mistakes. Just like what I have said, there are many things to consider before you start investing. A certified financial planner will help and guide you to prepare the things you should have and prepare before you will begin in your investing journey.

C. Start Investing in Stocks

Third, after you have consulted with a certified financial planner, start paying all your debts. Clear you credit card bills. Do not invest if you have a lot of debt to pay. Get out of debt and start investing. aside from getting out of debt, you must build an emergency funds good for 3 to 6 months equivalent of your monthly income. If your monthly income is $5,000, then you must have $30,000 emergency funds good for 6 months.

Aside from emergency funds, start buying a life insurance and health insurance. This insurance are also called as the income protection.

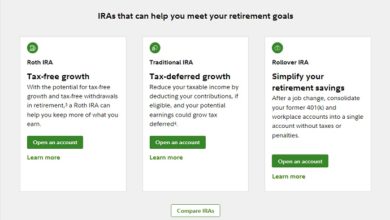

Have a financial map. Plan your investing strategies. Have a financial goal. Ask yourself, why do you want to start investing in stocks? Is it for the education of your children, for capital growth, or you just want to be a stockholder of your favorite companies like Apple, Microsoft or Coca-Cola? When do you want to start and until when do you want to stop. You must have an exit strategy. Maybe after 30 to 45 years, you will sell all your shares and make millions in the stock market. It depends on your financial goal.

How to Start Investing in Stocks (5 Steps with Pictures)

Here are the step by step procedures on how to start investing in stocks. I assumed you already know how the stock market works. You can make money with stocks in 2 ways, first is capital gains, seconds is through stock dividends.

Step 1. Open stock brokerage account

There are stock brokerage firms in every country that allows the investors to trade (buy and sell) stocks online. Choose the best brokerage company that can provide high quality service or those that offers low trading fees, FREE stock investing seminars, recommended stocks to buy, etc.

Step 2. Fund Your Stock Brokerage Account

After you have opened a stock brokerage account. Fund your account. Some stock brokerage firms allows you to fund your account for as low as $100 using bank deposit or remittances or over-the counter payments in their office.

Step 3. Search for the best stocks to buy

You can search on the internet. If you are a long-term stock investor, buy blue chip stocks. Blue chip stocks are the best stocks to buy. These stocks are from stable companies that reached globally, high quality company management team and a solid financial foundation (balance sheet). Example of US blue chip stocks are IBM, Coca-Cola, McDonalds, Wal-Mart Stores, Inc., JP Morgan Chase & Company and many more.

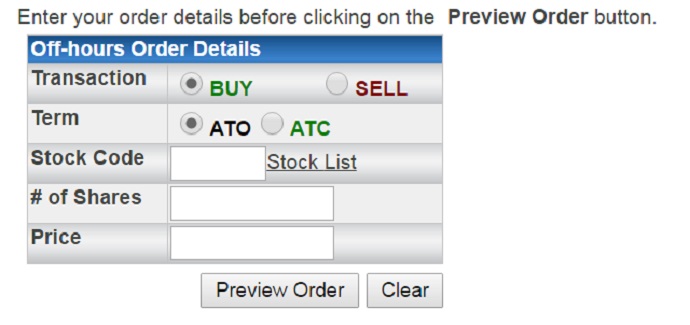

Step 4. Buy Stock Shares

You can’t buy stock shares if you didn’t fund your stock brokering account. Analyze the value of your chosen stock. If you chosen stock has a price of $20 per share with a board lot of 10, that means you can only buy a minimum of 10 shares worth $20 each. Therefore, your funds must worth ($20X10) $200 above include trading fees.

Related: How to Buy Stock Shares Online

Step 5. Decide when to sell your stocks

You can buy more stocks if you want. Just fund your account. Buying stocks in a regular basis every month means you are doing the so called “dollar cost averaging“. Example, you want to buy stocks worth $200 every month within 45 years. When the stock price increase you can only buy few shares, but when the stock price decreased you can buy more shares.

You didn’t know if you’re making real money in the stock market unless you will turn all your shares into cash. Do you still have any questions? I hope this page help you understand how to start investing in stocks. Feel free to ask other questions about investing. May you have a successful stock investing journey.

DISCLAIMER: The information provided on InvestmentTotal.com is for general informational purposes only. The content on this website is not intended to be, and should not be construed as, professional financial advice.