Know how to make millions in the stock market by choosing the best stocks to buy and tips when to sell them even if you are just a newbie investor.

Learn how to make millions in the stock market today. Stock market investing is simple, learn how to start investing in stocks before you read this guide. Through investing, you can make your money grow over a period of time. One of the best investment vehicles that allow you to grow your money is stock market. Making millions in investing is not difficult. You only need to take risks and manage those risks.

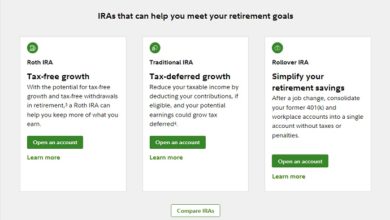

One of the benefits of investing in the stock market is that it can help you to earn a passive income when you retire (as long as you have chosen the right stocks). Aside from earning a passive income, being a company stockholder is also a great privilege.

Things Needed

The things you need when investing in the stock market are;

- Investment Capital – for as low as $100, you can buy stock shares.

- Government Identification Cards – for documentation purposes.

- Bank Account – some brokering companies require this.

- Stock Broker Account Opening Form – mostly downloadable online.

- Email Address – when opening a stock broker account online.

- Telephone Numbers or Mobile Number – for verification purposes.

How to Make Millions in the Stock Market?

It is not necessary to follow this tip, kindly consult with stock experts or to a certified financial planner before making an investment decision. Step by step guide procedures in making your first millions through stock market investing are as follows;

- Find a stock brokerage company in your own country. Say for example in USA, there is the ETrade, OptionHouse, etc.

- Open a trading account online. There are guides on the official website of the brokerage company, just follow the instructions given in their website. You need an email address, a bank account and the investment capital. You only need to fill in the form online. Just provide your personal information correctly.

- After your account was approved, fund your account. You can fund your account via bank deposit, wire transfer, some are via Paypal and some are through remittances. Read the guide on how to fund your account and follow what is convenient to you.

- When you have fund in your account, you can buy stock shares. But it is advisable to learn first the best stock to buy. When buying a stock shares, you can choose blue chips stocks or any of the company stocks you know about. Example, you can buy Apple, Inc. stock shares if you understand how this company is operating its business and how Apple, Inc. make money in technological industry even it has lot of competitors.

- Now, after you have chosen your stock. Buy stock shares. Making an investment goal is vital in your success. You have to analyze you investment horizon. Ask yourself when do you want to sell your stocks. Is it after 20 years, 30 years or above? Decide how much money to invest per month by first calculating your retirement target earning asset.

- Make additional investment per month. Keep on buying stock shares. That way, you can take advantage of dollar cost averaging wherein you can buy more shares if the share price is low and buy few shares if the price is high.

- If you invest $600 per month within 30 years you can make your first million in stocks. If you can maintain your stocks portfolio to earn at least 10% per year. A 10% earning rate per year is achievable in stocks investing.

Tips & Warnings

It is a wise decision if you choose stocks rather than parking your money in the bank that earn low interest rates. Before you invest in the stock market you should prepare the things to consider before investing money. You should pay all your debts (or lessen), build an emergency funds good for 3 to 6 months equivalent of your monthly income. Buy health and term life insurance.

If you are doing dollar cost averaging, do it regularly without skipping so that you can see great results. Buying blue chip stocks is recommended if you are doing dollar cost averaging. Do not forget to learn important things such as stock investing strategies and asset allocation strategies. A certified financial planner can help and guide you to succeed financially.

Hire Certified Financial Planner today if you can afford. If you can’t afford CFP fees, study and learn along the way. However, it will cost you too much money in doing the investing alone than hiring a certified financial planner.

Hey, thanks for a great post, it seems everyone these days is trying to make a little extra on the side but it is so hard to find really good blogs like yours. I’ve also been following this guy for a while and have had some success as a begginer using some of his methods. Maybe some of your readers might find it usefull too. https://www.affiliatemarketing101.com.au

https://www.affiliatemarketing101.com.au/home/10-basic-tips-for-success-in-affiliate-marketing