Find out how to invest money for retirement for teachers to ensure you retire comfortably after many years of teaching. Learn how teachers can invest money easily for retirement. Teachers should invest not only to save to retire comfortably. Savings is very different from investing. In personal finance, there are many topics to consider before investing your hard earned money.

As a teacher, you deserve to become rich and retire comfortably. Imagine you are molding young minds. Sooner, these young minds will have their own life. Having their own job and succeed. The sad thing is, your students are richer than you. Why not take time to read further about financial literacy.

Being a teacher is challenging but rewarding. Teaching is rewarding because without teachers, probably the world today is not that very progressive. In school, money had never been taught. When I am in high school, the subject matter in economics is “finances”, “world economy”, “world currencies”, but never been taught “investing”.

Here in Investing Advice for Beginners at InvestmentTotal.com, I inform every readers the beauty of investing. My husband is a public teacher. That’s why I want to share it this to you.

I hope every teacher will equip their selves knowledge and skills about money management and investing. So that, their students will learn from them the same thing. As a teacher, you should know how to make your money work for you during retirement age.

How to Invest Money for Retirement for Teachers?

And here’s how you do it. Just follow the simple instructions. Before anything else, let us first know the important things to prepare before investing money. It is advisable to have your emergency funds equivalent to the 6 months of your income.

Buy insurance. Term life and health care insurance is a must before investing your money. After you have prepared those things, pay all your debts and stop using credit card. Practice to live frugally. Attend financial literacy seminars.

1. Have a financial plan. How much money do you want to invest per month? How much portion of your income can you invest? Is it 20% of your monthly income or above 20%. Also, know the reasons why you are investing your money, some reasons might be for retirement or as a business capital, for your child’s education or another passive income.

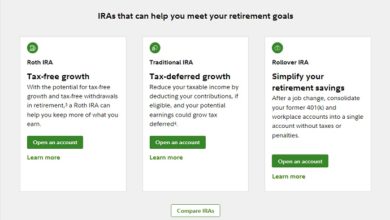

2. After drawing your financial map. Open an investment account. Decide which types of investment vehicle you want to invest. Is it in stocks, mutual funds or long-term bonds. While opening an investment account, a financial advisor will examine your risk profile. Do not skip that step. Risk profiling test is very important. If you have a low risk profile, try to invest money in bonds. If you are at high risk, try to invest in equity mutual funds or direct stocks investing. if moderate, try balance; combination of stocks and bonds.

Options When Investing Money for Retirement for Teachers

3. If you are a public teacher, you can invest money for retirement with automatic payments via 403 (b) plan. This automatic investment will auto deduct from your salary every month. The 403 (b) is okay especially if you can’t discipline yourself to invest money regularly. 403 (b) plan is another kind of retirement plan in USA. If you are not a public teacher, try 401(k).

Imagine if you invest $1,000 every year, your $1,000 will turn into; see data.

Initial Balance: $1,000

Compounding: Annually

Rate of Return: 18%

Years Invested: 20 Years

Future Value: $27,393.03

Initial Balance: $1,000

Compounding: Annually

Rate of Return: 23%

Years Invested: 20 Years

Future Value: $62,820.62

Compounding: Annually

Rate of Return: 18%

Years Invested: 20 Years

Future Value: $27,393.03Initial Balance: $1,000

Compounding: Annually

Rate of Return: 23%

Years Invested: 20 Years

Future Value: $62,820.62 – See more at: https://www.investmenttotal.com/2014/10/future-worth-of-1000-dollars-one-time-investments-20-years.html#sthash.FTNIuvdy.dpuf

Small Amount for Future

Compounding: Annually

Rate of Return: 18%

Years Invested: 20 Years

Future Value: $27,393.03Initial Balance: $1,000

Compounding: Annually

Rate of Return: 23%

Years Invested: 20 Years

Future Value: $62,820.62 – See more at: https://www.investmenttotal.com/2014/10/future-worth-of-1000-dollars-one-time-investments-20-years.html#sthash.FTNIuvdy.dpuf

Small amount of money per month can give you a big return in the future. Maybe you are asking, how much should I invest for retirement? Just compute first your retirement target earning asset so that you can easily find out how much money to invest per month for your retirement years.

Now you now how to invest money for retirement for teachers. Start planning for your retirement and invest automatically for your financial future. Believe me, you, as a teacher, deserve to become rich. To have a better life after you have spend all your life molding young minds. You are giving every children a good future, why not give yourself a chance to retire rich and comfortable.

DISCLAIMER: The information provided on InvestmentTotal.com is for general informational purposes only. The content on this website is not intended to be, and should not be construed as, professional financial advice.