Want to know how to fund your forex trading account online? Funding your FOREX trading account online seems to be easy especially if you are tech savvy, a computer literate and know how to follow simple instructions. Currency trading nowadays become a popular type of investing. Although it is risky, people still wants to invest in FOREX and expecting to gain profits after few hours and dreaming to get rich quick. Here in InvestmentTotal.com, it discuss all different types of investments including stocks, mutual funds, bonds, insurance and FOREX.

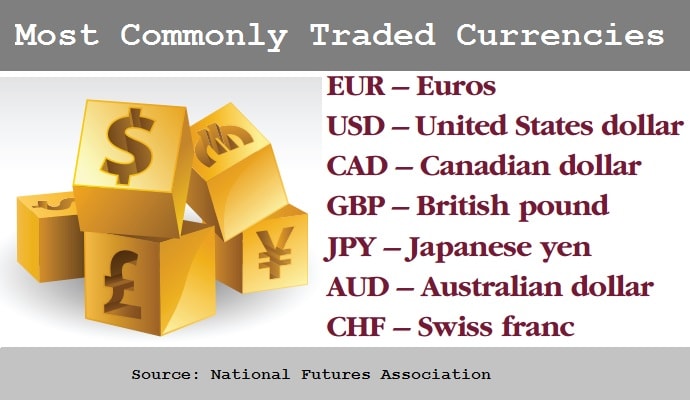

What is a FOREX Trading? It is an activity wherein traders or investors are buying and selling foreign exchange currency like US Dollars, EURO, YEN, Australian Dollars, Canadian Dollars etc. Some trading platforms aren’t only offer FOREX trading, they are also allows their members to trade commodities (Oil, Gold, Silver) and stocks.

The risk involve in FOREX trading is that the foreign exchange currency rate is volatile (rate fluctuation). Other risk to consider is if it is done online, it is hard to find which is legitimate and which is not. Losing investment capital in FOREX trading is possible, so beware of it. A FOREX is a high risk type of investment that can also give you a high potential ROI. It is up to you if you will take high risk or low risk types of investments. Make sure you know your goal, your risk appetite and know how to spot financial investment scam before investing your hard-earned money.

Fund Your FOREX Trading Account Online

If you have already joined a legitimate FOREX trading platform, consider to follow these step by step procedures on how to fund your account.

1. Log on to your account, using your username, email or password.

2. Look for any pages saying “fund your account” or “add funds”. These are the lines used by many platforms.

3. Visit the page that asking you to “add funds”. Fill out your data such as personal information, complete name, mailing address, email, and other websites are asking about your birth date.

4. Decide what to use in adding funds to your FOREX trading account. Some websites allows you to add funds via credit card or debit card. Some options to choose is an online payment processors like PayPal.

5. Give your credit card information, credit card number, name of the cardholder, expiration date, etc. (But do not give your CVV code of your credit card).

6. After you have transferred an account from your credit card or PayPal to a trading platform, kindly check your email for official receipt. You will also get notified by your bank about your transaction online when receiving your credit card bills.

7. Do not forget the official receipt. Save it in your desktop for future reference.

Tips & Warnings

To avoid losing money in FOREX trading, investigate and join only with the legitimate websites. Most websites has free trial and practice demo account. Take advantage of demo account to master the buy and sell activities in an online currency trading.

To succeed in FOREX trading, it is advisable to attend FOREX seminars, read a lot of books about FOREX investing or trading. Learn how to read charts, and equip yourself a knowledge and skills such as technical analysis. Ask other traders what strategies they are implementing. Experts FOREX traders can be found in an online forum, social sites and other investor’s clubs and associations.

Any other ways to fund your FOREX trading account online? Do you prefer to add funds in your trading account using PayPal or credit card? Leave a comment below.

DISCLAIMER: The information provided on InvestmentTotal.com is for general informational purposes only. The content on this website is not intended to be, and should not be construed as, professional financial advice.