Here is the amazing effect of saving 10 dollars if you invest and earns at least 8 percent annually within 20 years. Saving and investing are different from each other. Investing can help you make your money grow, while saving money alone can’t help you accumulate wealth faster. There are investment vehicles that can earn 8 percent or more annually. When you save money you will only get low interest rates.

Earning 10 dollars per day is easy. But do you think to save 10 bucks a day is easy, too? When you earn 10 bucks, do you prefer to save it or spend it? Saving 10 dollars daily is very easy compare to saving $300 per month. Maybe you ask, they are the same amount of money. If you save 10 dollars everyday within 30 years, you will have $300. What’s the difference?

The difference is that when you have $300, you will not save it because you will think that will be a good money to buy new stuffs (gadgets) like phone, laptop, clothes or shoes. But, when you have only $10, you will think it’s only a small amount, and your mind then will think it is better to save it than to spend it.

Now, imagine saving 10 dollars daily. Yes, after 30 days you will get $300. Saving $10 after a year (365 days) will give you a total of $3,650.00

Investing 10 Dollars Daily that Earns 3 to 8 Percent Annually

That’s not the amount of money we want to save. We want enough retirement funds or enough money to buy for a new car, a new house or enough college funds to ensure the future of our children. Take a look at the amazing effect of saving $10 daily that earns eight percent annually.

Regular Deposits: 10 Dollars

Interest Rate: 1%

Compound Frequency: Annually

Number of Years (Investment Horizon): 20 Years

Total Interest: $7,369.00

Total Savings: $80,369.00

Regular Deposits: 10 Dollars

Interest Rate: 5%

Compound Frequency: Annually

Number of Years (Investment Horizon): 20 Years

Total Interest: $47,691.00

Total Savings: $120,691.00

Regular Deposits: 10 Dollars

Interest Rate: 8%

Compound Frequency: Annually

Number of Years (Investment Horizon): 20 Years

Total Interest: $94,031.00

Total Savings: $167,031.00

Saving 10 Dollars for Your Retirement

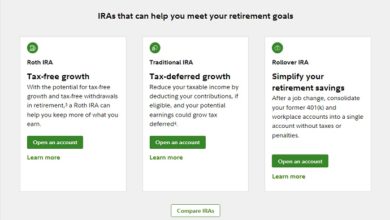

Imagine having $167,031.00 after 20 years. That’s a good money. It’s not that big but I think if you add that amount in your retirement savings, that’s would be a big help. Another question to consider is “where to invest your money that can earn 8 percent interest annually?”.

That’s a good question. Because keeping or saving your money in the bank will not give you high interest rate. Since you have a long investment horizon (20 years), you can try high risk such as stocks and mutual fund equity.

How to Earn 8 Percent Interest for Your Investment

Any types of investment that can earn 8% annually is awesome. However, the average interest earn per year is 7%. The key is to investment management. All you need to do is to track your investment every year and do not forget to distribute your investment properly by using asset allocation. Invest according to your age, needs, investment goals and risk tolerance.

We know that getting 8 percent rate of return on investment is reasonable. What if your investment will only earn 7 percent per year? What’s the future value of 1o dollars daily?

After 20 years, your total savings is $149, 634.00; still a good money for retirement. Right? So, start saving small amount of money today. But don’t just save your 10 dollars, invest it to get reasonable returns.

DISCLAIMER: The information provided on InvestmentTotal.com is for general informational purposes only. The content on this website is not intended to be, and should not be construed as, professional financial advice.