Looking for retirement investment options? Here are some of the guide when choosing the best investment options for your retirement. Don’t just save money for retirement, invest and make your money grow.

A reader of Retirement Planning IQ asked a question last night about the best retirement investment options. Here’s the letter from Mr. McGregor from Florida, USA;

I am not familiar with different types of retirement investment or savings account. I am so busy working and I have no time to invest and no time to analyze the market just like what other investors are doing. What I want to know is the best retirement investment options that requires less effort on my part. My goal is just to save and invest for retirement. Any idea?

Ben McGregor, Florida, USA (March 7, 2016)

7 Retirement Savings Account

There are 7 Retirement Savings Accounts You Should Consider according to Teresa Mears published on USNews Money. She said “For most people, especially young people, the best place to start is with the 401(k) program at work. “ (1)

- 401(k) or 403(b) offered by your employer.

- Solo 401(k).

- SEP IRA. Simplified Employee Pension.

- Simple IRA.

- IRA.

- Roth IRA.

- Health savings account.

Mitch Tuchman is a contributor in Forbes under investing topics. He write about the challenges facing serious retirement investors. He said in his article,

“Retirees, understandably, are concerned with largely two things: safety and income. Retirement investments often combine these features, but at a cost.” (2)

3 Retirement Investment Options for a Strong Retirement

1. Buy an annuity

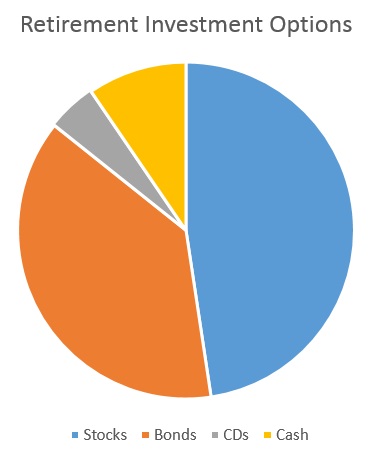

2. Own a mix of stocks and bonds

3. Build a portfolio and manage it cheaply

I like the idea of owning a mix of stocks and bonds as the retirement investment options. Actually, that should be recommended. If we follow asset allocation for retirement, you still need to have to invest in a high risk types of investment like stocks. But be careful not to invest all your retirement funds in the stock market. That’s the reason why Mitch Tuchman added the option number three, you have to build a balanced investment portfolio.

Source and References:

- (1) 7 Retirement Savings Account You Should Consider

- (2) Forbes Best Investment for a Strong Retirement

So, the answer to Ben McGregor question about the best retirement investment options is this;

Answer: Ben should invest money for retirement automatically. His best options is to open an individual retirement account or one of the common retirement savings account like 401k. Like waht Teresa Mears stated; “…best place to start is with the 401(k) program at work. ”

If Ben is still young and have long investment horizon, he should invest in a high risk types of investment like the stock market or mutual fund index fund and mutual fund equity fund. He can afford to take high risks because he still young. However, when Ben’s age and needs changed, he should carefully taking risk by means of asset allocation.

What about you? What would be the advice you give to Ben McGregor? Does the answer of Retirement Planning IQ blog make sense to you? Share some of the best retirement investment options using the comment box below. Share this page with your friends in Facebook and Twitter. Thank you.

DISCLAIMER: The information provided on InvestmentTotal.com is for general informational purposes only. The content on this website is not intended to be, and should not be construed as, professional financial advice.