Learn asset allocation by age and risk tolerance today if you want to diversify your investments and avoid capital loss. Many successful investors believe in diversification in investing money. Diversification simply means putting your total investments in different vehicle. Spreading your investments can help you recover your other losses.

If you are following InvestmentTotal.com, you will already read our asset allocation models. We already published articles about how to distribute assets if the investor is at age 40, 45, 50, 55, age 60 and above.

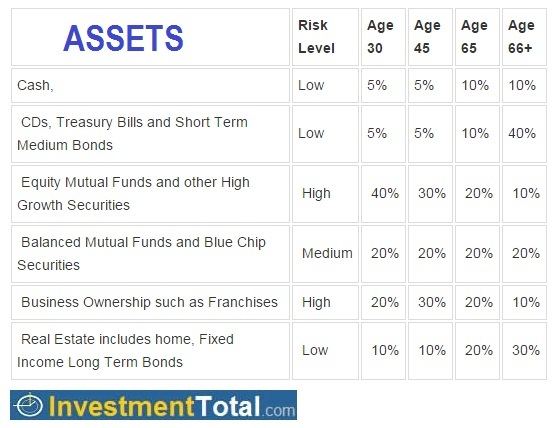

Asset Allocation Strategies by Age

The table above shows that an investor whose age 30 should invest 20% of his total assets in low risk vehicles such as CDs, treasury bills, short-term and medium bonds and cash. He should also invest 40% of his total assets in high risk vehicles like equity mutual funds and other high growth securities and 20% for business ownership. 20% of his total assets should invest in medium risk investments such as balanced mutual funds and blue chip securities. While the other 10% should invest in low risk types of investments such as real estate and fixed income long-term bonds.

See the table above, follow it as your guide when you want to divide your asset every year. If our blog make some updates, you will see this portfolio asset allocation in our exclusive page at investing guide for newbie investors.

What about you? Have you diversified your total assets already? Do you know your risk tolerance? Did you hire a certified financial planner to guide you distribute your total assets properly? Please share your investing experience below! Thank you!

DISCLAIMER: The information provided on InvestmentTotal.com is for general informational purposes only. The content on this website is not intended to be, and should not be construed as, professional financial advice.